Dalian iron ore futures edged lower on Friday, pressured by rising inventories at major Chinese ports and a slight increase in finished steel stocks at key warehouses. However, losses were limited by expectations of stronger near-term demand, with analysts pointing to restocking ahead of the Chinese New Year holidays in February and a gradual recovery in steel output as environmental curbs ease and more mills complete maintenance.

Recent macro data also lent some support to sentiment. China’s consumer inflation accelerated to 0.8pct YoY in December, its fastest pace in nearly three years, while the decline in producer prices narrowed to 1.9pct YoY, compared with a 2.2pct drop in November, signalling ongoing policy support to stabilize the economy.

In the physical market, traders said the newly introduced steel import licensing regime has created logistical bottlenecks, with shipments delayed at ports amid unclear and uneven implementation. While non-VAT steel offers have declined, they have not fully disappeared, adding to near-term market uncertainty.

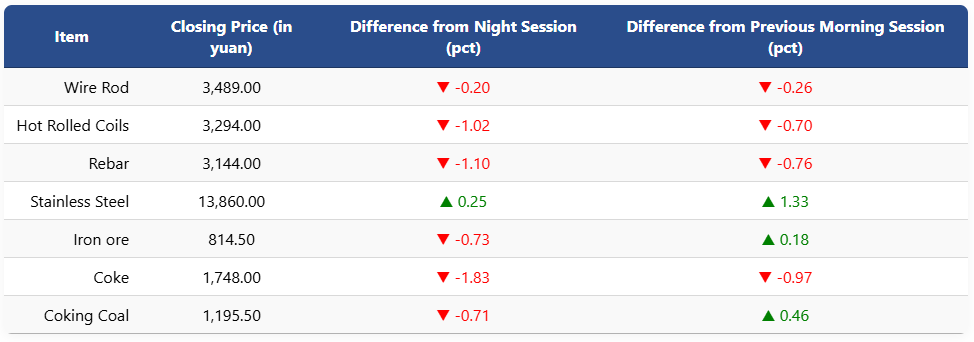

On the Dalian Commodity Exchange, the most-traded May iron ore contract slipped 0.73pct to 814.5 yuan (USD 116.6) per ton, though it remained 3.17pct higher than last Friday’s morning close. Coking coal and coke futures fell 0.71pct and 1.83pct to 1,195.5 yuan (USD 171) and 1,748 yuan (USD 250) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures declined 1.1pct to 3,144 yuan (USD 450) per ton, while HRC futures dropped 1.02pct to 3,294 yuan (USD 472) per ton. Wire rod edged down 0.2pct to 3,489 yuan (USD 500) per ton, while stainless steel futures inched up 0.25pct to 13,860 yuan (USD 1,985) per ton.

1 USD / 6.98 yuan