Iron ore futures declined on Thursday as market sentiment remained cautious, with expectations of improving demand yet to fully materialize.

Higher iron ore inventories at major Chinese ports, rising global supply, and the slow pace of recovery in Chinese steel production continued to weigh on prices.

Market attention was also drawn to reports that some private Chinese traders had offloaded iron ore cargoes from BHP, which had previously faced purchase restrictions by the state-backed China Mineral Resources Group (CMRG). This move was seen as a test of the limits of those restrictions and may signal a partial easing for private buyers, although any relaxation could add further pressure to prices. Industry sources said CMRG is surveying mills on their stockpiles of the restricted ore, potentially to manage port congestion.

While Chinese steel output has shown gradual improvement, growth remains limited, dampening expectations for strong restocking ahead of the Chinese New Year holidays in February.

Chinese steel traders also noted that the new steel export licensing regime has temporarily slowed export activity, though shipments could recover in the near term. Overall, seasonal factors and the absence of strong upside drivers are keeping the market rangebound.

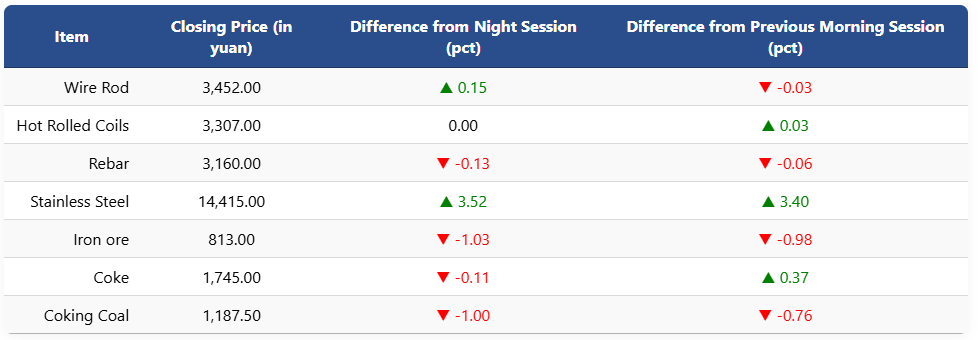

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 1.03pct to 813 yuan (USD 116.6) per ton. Coking coal and coke futures declined 1pct and 0.11pct to 1,187.5 yuan (USD 170) and 1,745 yuan (USD 250) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures edged down 0.13pct to 3,160 yuan (USD 453) per ton, while HRC was unchanged at 3,307 yuan (USD 475) per ton. Wire rod futures rose 0.15pct to 3,452 yuan (USD 495) per ton, and stainless steel futures climbed 3.52pct to 14,415 yuan (USD 2,069) per ton.

1 USD / 6.97 yuan