Iron ore futures fell on Tuesday as market sentiment weakened following a fatal accident at a Chinese steel plant, raising concerns over tighter safety inspections and their potential impact on steel production.

An explosion at a plant owned by Baotou Steel has sparked fears of widespread government safety checks across China, which market participants say could lead to temporary production suspensions and weaker demand for iron ore.

Sentiment was further weighed down by rising global iron ore supply. BHP reported record iron ore output in the first half of FY26 ended December 2025, while new supply from the Simandou iron ore mine added to oversupply concerns after its first commercial shipment arrived in China this week, at a time when iron ore inventories at major Chinese ports are already at high levels.

Some analysts said the growing supply pressure could offset expectations of restocking demand ahead of the Chinese New Year holidays in February, traditionally a period of increased raw material buying by steel mills.

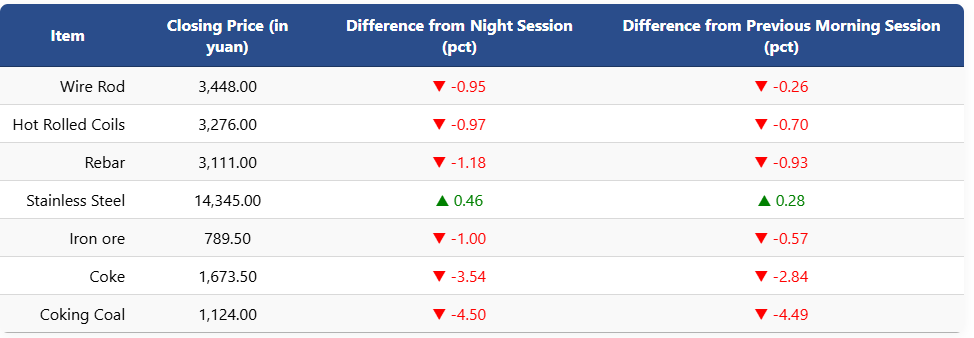

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 1pct to 789.5 yuan (USD 113.4) per ton. Coking coal and coke futures also dropped sharply, down 4.5pct and 3.54pct to 1,124 yuan (USD 162) and 1,673.5 yuan (USD 240) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures declined 1.18pct to 3,111 yuan (USD 447) per ton, HRC fell 0.97pct to 3,276 yuan (USD 471), and wire rod slipped 0.95pct to 3,448 yuan (USD 495). In contrast, stainless steel futures rose 0.46pct to 14,345 yuan (USD 2,061) per ton.

1 USD / 6.95 yuan