Iron ore futures extended losses on Tuesday as the market remained cautious amid rising supply and subdued steel demand.

Iron ore prices continued to face pressure from record-high inventories at major Chinese ports, which offset any limited support from restocking activity by steel mills.

At the same time, the lack of upward momentum in domestic steel prices has prompted some mills to bring forward maintenance ahead of the Lunar New Year, potentially reducing near-term iron ore consumption.

Steel demand also remained weak due to winter-related disruptions, particularly in the construction sector. Steel traders said ample steel supply and slowing demand are keeping the physical market under pressure, contributing to a modest decline in spot prices.

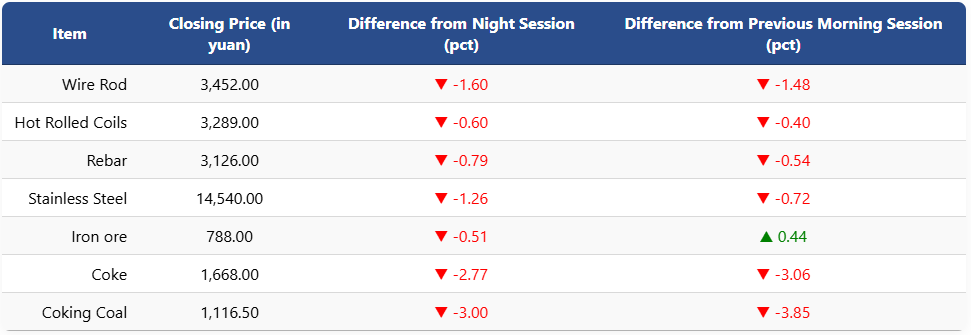

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.51pct to 788 yuan (USD 113.3) per ton. Coking coal and coke futures declined 3pct and 2.77pct to 1,116.5 yuan (USD 161) and 1,668 yuan (USD 240) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures slipped 0.79pct to 3,126 yuan (USD 449) per ton, HRC fell 0.6pct to 3,289 yuan (USD 473), and wire rod dropped 1.6pct to 3,452 yuan (USD 496). Stainless steel futures declined 1.26pct to 14,540 yuan (USD 2,091) per ton.

1 USD / 6.95 yuan