Iron ore futures extended losses on Thursday for a fourth consecutive session, as weak fundamentals and ample supply continued to pressure the market. Rising global shipments and higher inventories at Chinese ports are limiting any near-term upside for prices.

Demand-side conditions remain soft, with restocking activity fading ahead of the Lunar New Year holidays. Market participants said that even a stable or marginal recovery in steel production is unlikely to support iron ore prices given the current supply overhang.

Chinese steel traders noted that winter-related seasonal slowdowns have dampened steel demand, particularly as construction activity slows across many regions. This has led to rising finished steel inventories at major warehouses. Prices remain largely range-bound, with traders seeing limited upside before the holiday period, and clearer market direction expected only after the holidays.

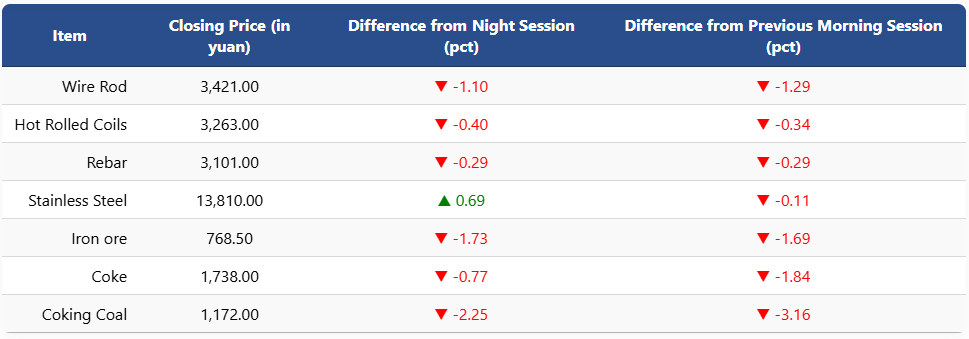

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 1.73pct to 768.5 yuan (USD 110.7) per ton. Coking coal and coke futures also declined by 2.25pct and 0.77pct to 1,172 yuan (USD 169) per ton and 1,738 yuan (USD 251) per ton, respectively.

Meanwhile, on the Shanghai Futures Exchange, rebar futures eased 0.29pct to 3,101 yuan (USD 447) per ton, while HRC slipped 0.4pct to 3,263 yuan (USD 470). Wire rod futures dropped 1.1pct to 3,421 yuan (USD 493). In contrast, stainless steel futures edged up 0.69pct to 13,810 yuan (USD 1,991) per ton.

1 USD / 6.93 yuan