Iron ore futures fell on Friday, extending losses across all morning sessions this week, as weak fundamentals continued to weigh on market sentiment.

Iron ore futures remained under pressure due to higher port-side inventories in China and fading pre-holiday restocking demand, while recent steel production data further dampened confidence.

According to the China Iron and Steel Association (CISA), average daily crude steel output among member mills in late January 2026 fell 2.2pct from mid-January to 1.935 mln tons.

Chinese steel traders said winter-related demand softness persists in the domestic market, keeping prices range-bound. Export activity also remains weak, partly due to the newly introduced licensing regime, with no meaningful improvement expected ahead of the Lunar New Year holidays starting on February 15.

Sentiment in futures markets was further pressured by sharp declines across global commodities, driven by broader risk-off moves linked to concerns over heavy AI-related spending.

While some analysts pointed to potential supply disruptions from Australia due to cyclone risks, they said any support for iron ore prices is likely to be limited given already high inventories at Chinese ports.

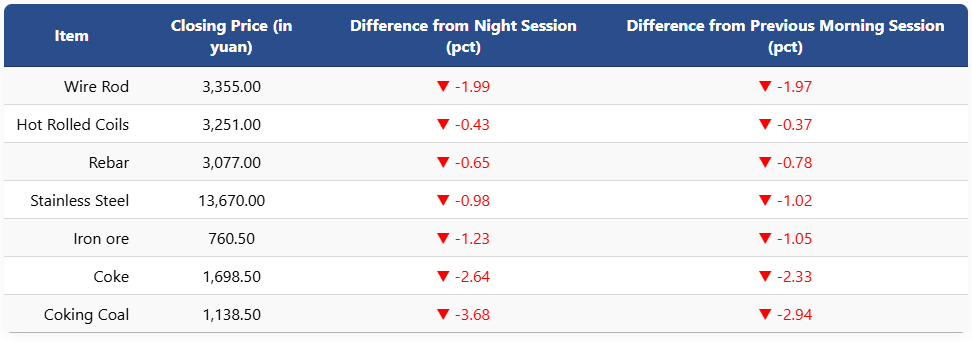

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 1.23pct to 760.5 yuan (USD 109.6) per ton, down 3.92pct from last Friday’s morning-session close. Coking coal and coke futures also declined by 3.68pct and 2.64pct to 1,138.5 yuan (USD 164) per ton and 1,698.5 yuan (USD 251) per ton, respectively.

Meanwhile, on the Shanghai Futures Exchange, rebar futures eased 0.65pct to 3,077 yuan (USD 443) per ton, while HRC slipped 0.43pct to 3,251 yuan (USD 469). Wire rod futures dropped 1.99pct to 3,355 yuan (USD 484), and stainless steel futures fell 0.98pct to 13,670 yuan (USD 1,970) per ton.

1 USD / 6.93 yuan