Iron ore futures declined on Monday, pressured by weak steel demand and falling production in China.

Rising inventories at major Chinese ports and cautious restocking by steel mills have further dragged down prices. Many mills have also brought forward maintenance schedules, curbing steel output even more.

Chinese authorities are aiming to keep annual steel production near 1 bln tons. Between January and September 2025, crude steel output reached 746 mln tons amid subdued demand. According to the China Iron and Steel Association (CISA), apparent steel consumption dropped 5.7pct to 649 mln tons, indicating that consumption is falling faster than production.

Seasonal environmental restrictions expected during winter are likely to further constrain output, reinforcing the bearish outlook for steel and raw materials.

Market participants note that finished steel prices remain under pressure, and without stronger policy support, a near-term recovery appears unlikely.

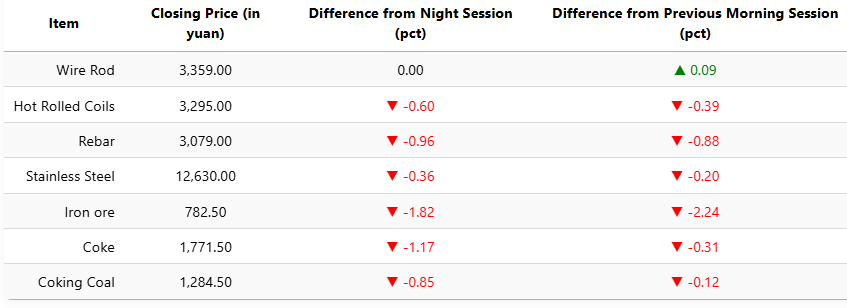

On the Dalian Commodity Exchange, the most-traded January iron ore contract fell 1.82pct to 782.5 yuan (USD 109.8) per ton. Coking coal futures slipped 0.85pct to 1,284.5 yuan (USD 180), while coke declined 1.17pct to 1,771.5 yuan (USD 249) per ton.

On the Shanghai Futures Exchange, rebar futures dropped 0.96pct to 3,079 yuan (USD 432) per ton, while HRC fell 0.6pct to 3,295 yuan (USD 463). Wire rod futures were unchanged at 3,359 yuan (USD 472), and stainless steel edged down 0.36pct to 12,630 yuan (USD 1,774) per ton.

1 USD / 7.12 yuan