Iron ore futures continued to fall on Wednesday as sluggish steel demand and reduced mill production kept market sentiment bearish.

Chinese steelmakers have been scaling back operations due to shrinking margins, while environmental output restrictions are expected to further dampen consumption, reflected in rising port-side iron ore inventories.

The outlook remains weighed down by persistent weakness in China’s property sector, weather-related slowdowns in construction activity, and growing protectionist measures targeting Chinese steel exports.

Chinese steel traders said domestic steel prices remain under pressure, with little sign of recovery amid sluggish downstream demand.

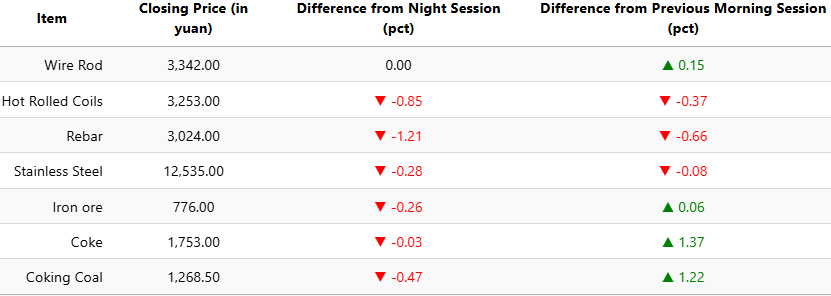

On the Dalian Commodity Exchange, the most-traded January iron ore contract slipped 0.26pct to 776 yuan (USD 108.8) per ton. Coking coal fell 0.47pct to 1,268.5 yuan (USD 178), while coke edged down 0.03pct to 1,753 yuan (USD 246) per ton.

On the Shanghai Futures Exchange, rebar dropped 1.21pct to 3,024 yuan (USD 424), HRC fell 0.85pct to 3,253 yuan (USD 456), wire rod was flat at 3,242 yuan (USD 455), and stainless steel declined 0.28pct to 12,535 yuan (USD 1,759) per ton.

1 USD / 7.12 yuan