Iron ore futures rose for the first time this week on Thursday, supported by restocking activity at some Chinese steel mills taking advantage of lower prices.

However, gains were limited by persistent demand concerns. Market fundamentals remain weak due to rising port inventories, sluggish steel demand, narrowing mill margins, and environmental output curbs in several Chinese regions.

According to the China Iron and Steel Association (CISA), the average daily crude steel output of member mills in the last ten days of October fell to 1.81 mln tons, down 9.8pct from the previous ten-day period and more than 13pct YoY.

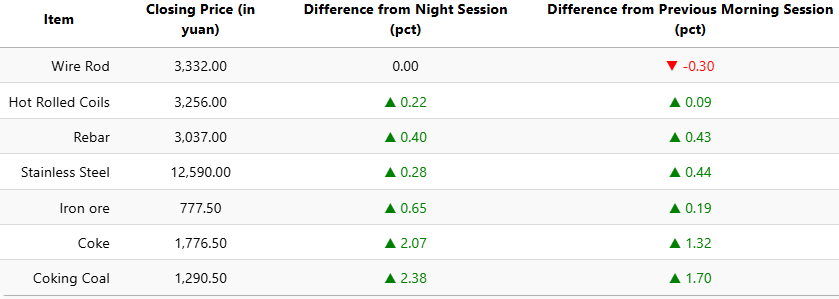

On the Dalian Commodity Exchange, the most-traded January iron ore contract gained 0.65pct to 777.5 yuan (USD 109.1) per ton. Coking coal rose 2.38pct to 1,290.5 yuan (USD 181), and coke climbed 2.07pct to 1,776.5 yuan (USD 249) per ton.

On the Shanghai Futures Exchange, rebar added 0.4pct to 3,037 yuan (USD 426), HRC inched up 0.22pct to 3,256 yuan (USD 457), wire rod was steady at 3,332 yuan (USD 468), and stainless steel edged 0.28pct higher to 12,590 yuan (USD 1,768) per ton.

1 USD / 7.12 yuan