Iron ore futures declined on Friday as weak demand and reduced steel output weighed on market sentiment.

Chinese steel production continues to slow, with mills cutting output due to shrinking profitability and soft demand. Environmental restrictions in several regions are further curbing production, reducing iron ore consumption.

Rising port inventories indicate mills remain cautious about restocking, while supply pressure persists as major exporters ramp up shipments to meet annual targets.

Chinese steel traders noted that steel demand in the physical market remains sluggish, with downstream buyers hesitant to replenish inventories ahead of winter. In the absence of fresh policy support from Beijing, the market remains stuck in a weak cycle.

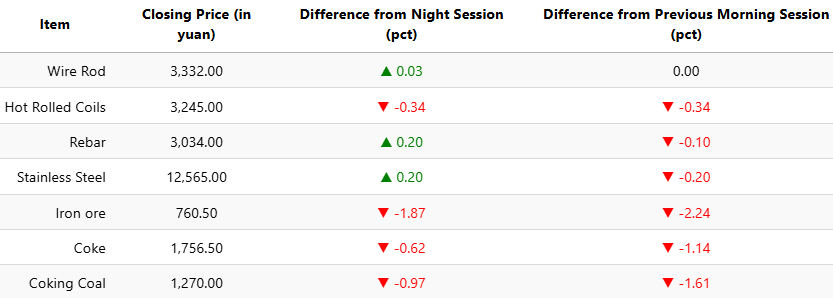

On the Dalian Commodity Exchange, the most-traded January iron ore contract fell 1.87pct to 760.5 yuan (USD 106.7) per ton, also down 2.81pct from last Friday’s morning close.

Coking coal futures slipped 0.97pct to 1,270 yuan (USD 178), and coke prices dropped 0.62pct to 1,756.5 yuan (USD 247) per ton.

On the Shanghai Futures Exchange, rebar inched up 0.2pct to 3,034 yuan (USD 426), HRC fell 0.34pct to 3,245 yuan (USD 456), wire rod was almost unchanged at 3,332 yuan (USD 468), and stainless steel edged 0.2pct higher to 12,565 yuan (USD 1,764) per ton.

1 USD / 7.12 yuan