Iron ore futures advanced on Wednesday, although uncertainty persists over the demand outlook.

Market participants said prices were partly supported by expectations of fresh stimulus and relatively firm production levels. Despite recent declines, production remains high, lending some support to iron ore prices.

However, the weak outlook for the steel sector continues to weigh on sentiment. Soft downstream demand and abundant supply have kept finished steel prices under pressure, squeezing margins for Chinese mills. This may prompt producers to scale back output to protect profitability.

Iron ore sentiment is also capped by higher portside inventories and rising supply, as Guinea’s large Simandou project has started production.

Some Chinese traders observed that domestic steel demand is showing early signs of stabilization as mills cut output, which is helping to ease inventory and price pressure. Still, without additional policy support, significant price gains are unlikely in the near term, particularly with the traditional winter slowdown approaching.

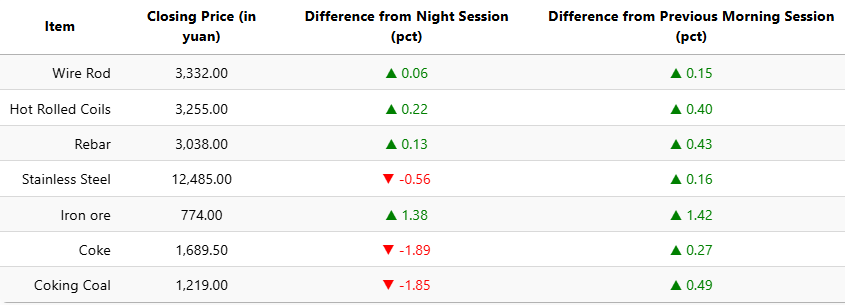

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 1.38pct to 774 yuan (USD 108.7) per ton. Coking coal fell 1.85pct to 1,219 yuan (USD 171), while coke declined 1.89pct to 1,689.5 yuan (USD 237) per ton.

On the Shanghai Futures Exchange, rebar edged up 0.13pct to 3,038 yuan (USD 427), HRC gained 0.22pct to 3,255 yuan (USD 457), and wire rod inched higher to 3,332 yuan (USD 468). Stainless steel futures slipped 0.56pct to 12,485 yuan (USD 1,754) per ton.

1 USD / 7.11 yuan