Iron ore futures edged higher on restocking demand ahead of the winter season, though the broader outlook remains bearish due to weakening fundamentals.

Analysts noted that some Chinese steel mills are replenishing inventories to avoid weather-related logistics disruptions in the winter months. Higher crude steel output also lent some short-term support. According to the China Iron and Steel Association (CISA), daily crude steel production at member mills rose 6pct in early November compared with late October, reaching 1.926 mln tons, but still down 8pct YoY.

However, Chinese steel demand remains soft. CISA reported that finished steel inventories at member mills increased nearly 6pct to 15.49 mln tons in early November, reflecting sluggish downstream offtake.

While elevated production levels support iron ore consumption in the near term, analysts warned that rising finished steel supply continues to pressure prices and margins. This could prompt mills to bring forward maintenance shutdowns, reducing output and limiting any upside in iron ore.

Sentiment is also weighed down by China’s slowing economic momentum in October, impacted by weak consumer demand and a deepening property downturn.

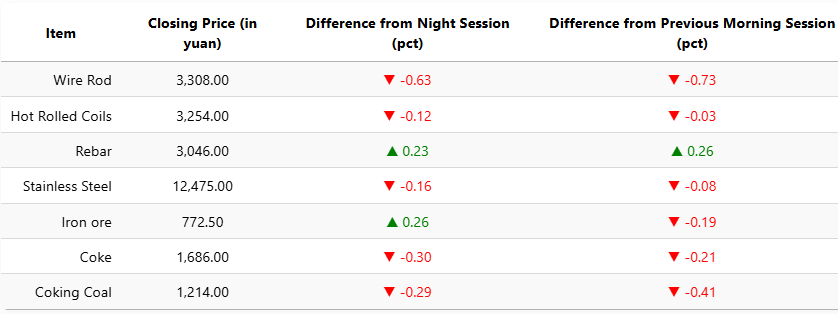

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 0.26pct to 772.5 yuan (USD 108.8) per ton, up 1.58pct from last Friday’s morning close. Coking coal fell 1.77pct to 1,192 yuan (USD 170), while coke slipped 1pct to 1,669.5 yuan (USD 235) per ton.

On the Shanghai Futures Exchange, rebar gained 0.43pct to 3,053 yuan (USD 430), HRC edged higher to 3,256 yuan (USD 459), wire rod fell 1.81pct to 3,257 yuan (USD 459), and stainless steel declined 0.76pct to 12,380 yuan (USD 1,744) per ton.

1 USD / 7.09 yuan