Iron ore futures slipped on Thursday as rising global supply and soft steel demand continued to weigh on sentiment, though restocking by some Chinese mills helped limit the decline.

Prices also found some support from a Bloomberg report indicating that Beijing may roll out a new and more aggressive stimulus package for the struggling property sector, formerly a major driver of steel consumption.

Still, strong iron ore arrivals into China, higher port inventories, and growing seaborne supply kept the outlook bearish. Weak downstream steel demand continues to pressure finished steel prices and squeeze mill margins, raising the risk of production cuts to rebalance supply.

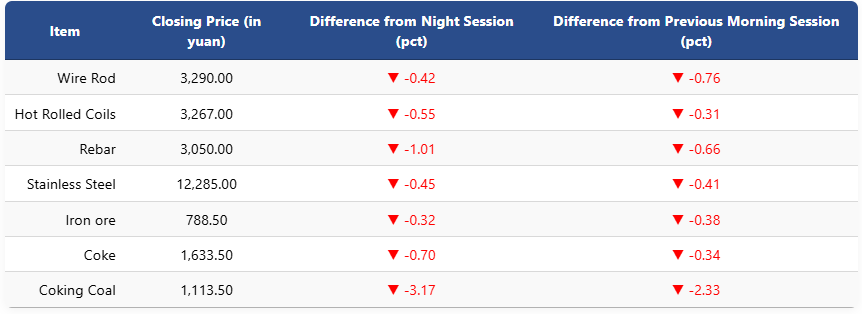

On the Dalian Commodity Exchange, the most-traded January iron ore contract dipped 0.32pct to 788.5 yuan (USD 110.8) per ton. Coking coal fell 3.17pct to 1,113.5 yuan (USD 157), while coke eased 0.7pct to 1,633.5 yuan (USD 230) a ton.

On the Shanghai Futures Exchange, rebar declined 1.01pct to 3,050 yuan (USD 429), HRC dropped 0.55pct to 3,267 yuan (USD 459), wire rod eased 0.42pct to 3,290 yuan (USD 462), and stainless steel slipped 0.45pct to 12,285 yuan (USD 1,727) per ton.

1 USD / 7.11 yuan