Iron ore futures fell on Monday as soft economic data and lingering weakness in China’s property sector continued to weigh on market sentiment, alongside lower steel production figures for last year.

Data from the National Bureau of Statistics showed China’s crude steel output declined 4.4pct YoY to 960.81 mln tons in 2025, the lowest level in seven years. December production fell 2.4pct month on month to 68.18 mln tons, marking the seventh consecutive monthly decline and a 10.3pct drop YoY.

Property indicators remained weak. Average home prices in 70 major cities fell 0.4pct month on month in December and 2.7pct YoY, underscoring the prolonged downturn in the sector. The slump has continued to pressure steel demand, as the property market, once a key consumer, has yet to recover, while gains in manufacturing and infrastructure have not fully offset the shortfall. China’s fixed-asset investment also declined 3.8pct YoY in 2025, further limiting steel consumption.

Although China met its 5pct GDP growth target last year, supported largely by strong exports, analysts noted that persistent domestic weakness and rising trade protectionism could pose challenges in 2026, prompting calls for additional measures to stimulate internal demand.

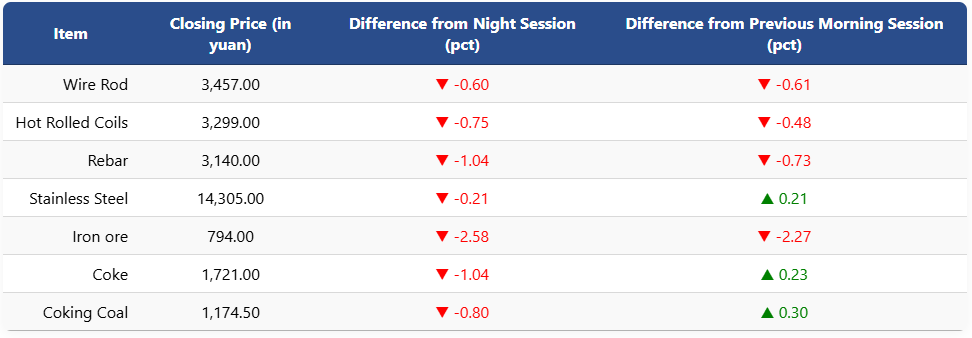

On the Dalian Commodity Exchange, the most-traded May iron ore contract dropped 2.58pct to 794 yuan (USD 114) per ton. Coking coal and coke futures declined 0.8pct and 1.04pct to 1,174.5 yuan (USD 169) and 1,721 yuan (USD 247) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures fell about 1pct to 3,140 yuan (USD 451) per ton, HRC slipped 0.75pct to 3,299 yuan (USD 474), and wire rod declined 0.6pct to 3,457 yuan (USD 496). Stainless steel futures edged down 0.21pct to 14,305 yuan (USD 2,054) per ton.

1 USD / 6.96 yuan