Iron ore futures jumped on Monday as expectations of new economic stimulus from Beijing boosted market sentiment.

Commodity markets gained after China’s finance minister signalled that fiscal policy will be strengthened over the next five years, with increased use of budgetary tools and government bonds to support economic growth.

Restocking activity by some steel mills ahead of winter, along with still-elevated steel production levels, also supported iron ore demand.

However, the broader outlook remains uncertain. Excess finished steel supply continues to pressure steel prices and margins, raising the risk of future output cuts. Iron ore also faces headwinds from environmental production curbs, rising protectionist measures targeting Chinese steel exports and ongoing weakness in the property sector.

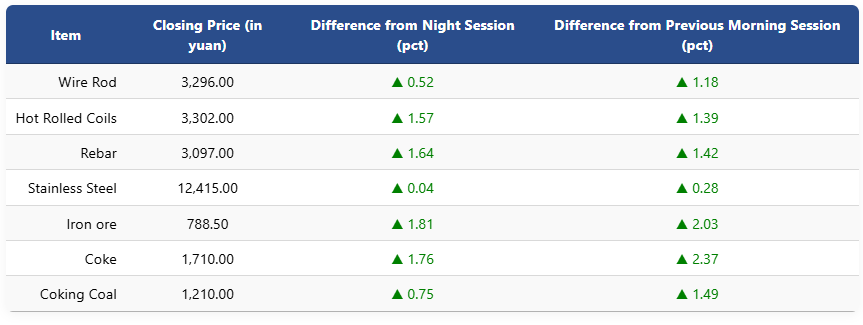

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 1.81pct to 788.5 yuan (USD 110.9) per ton. Coking coal increased 0.75pct to 1,210 yuan (USD 170), while coke gained 1.76pct to 1,710 yuan (USD 241).

On the Shanghai Futures Exchange , rebar climbed 1.64pct to 3,097 yuan (USD 436), HRC rose 1.57pct to 3,302 yuan (USD 465), wire rod gained 0.52pct to 3,296 yuan (USD 464), and stainless steel edged up to 12,415 yuan (USD 1,747) per ton.

1 USD / 7.1 yuan