Iron ore futures declined on Tuesday as persistent demand weakness and ample supply continued to weigh on market sentiment. Higher shipments from major miners, combined with rising inventories at Chinese ports, kept prices under pressure.

Slowing domestic steel demand and environmentally driven production curbs have prompted some Chinese mills to bring forward maintenance schedules, potentially reducing iron ore consumption. At the same time, pre-holiday restocking activity is gradually fading ahead of the Lunar New Year.

Steel traders in China said export sales remain sluggish due to weak demand in traditional markets and initial challenges linked to a newly implemented licensing regime introduced at the start of the year. Domestic demand is also expected to soften further as the Lunar New Year holidays begin in mid-month.

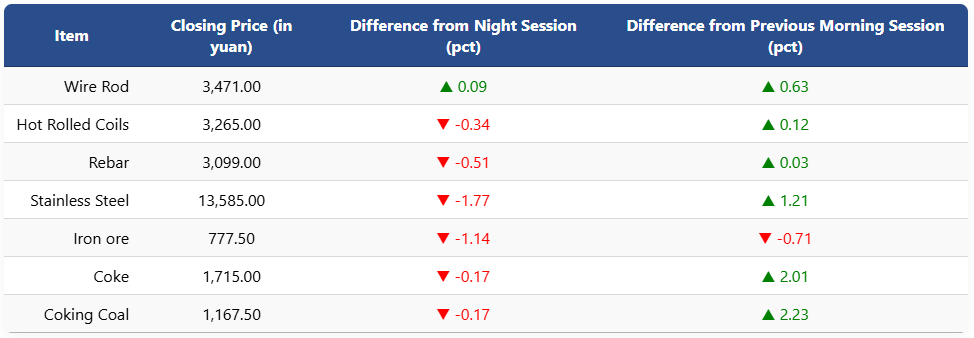

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 1.14pct to 777.5 yuan (USD 112) per ton. Coking coal and coke futures both eased 0.17pct to 1,167.5 yuan (USD 168) per ton and 1,715 yuan (USD 247) per ton, respectively.

Meanwhile, on the Shanghai Futures Exchange, rebar futures slipped 0.51pct to 3,099 yuan (USD 447) per ton, while HRC declined 0.34pct to 3,265 yuan (USD 471). Wire rod futures edged up to 3,471 yuan (USD 500). Stainless steel futures fell 1.77pct to 13,585 yuan (USD 1,958) per ton.

1 USD / 6.93 yuan