Iron ore futures edged lower on Tuesday as a bearish outlook continued to pressure the market. A seasonal slowdown in steel demand has prompted many Chinese steel mills to schedule maintenance, a trend expected to further curb steel output and reduce iron ore consumption.

Market sentiment was also weighed down by higher portside iron ore inventories, with winter restocking yet to gain momentum.

In addition, uncertainty surrounding the new steel export licensing system, set to take effect from January 1, 2026, has added to caution. Some analysts believe the measure could moderate China’s robust steel exports next year. While strong exports helped offset weak domestic demand this year, they also triggered protectionist responses from several countries. Traders reported stricter port inspections for December-end cargoes, as suppliers rush shipments ahead of the new rules, with some sellers pausing offers until more clarity emerges.

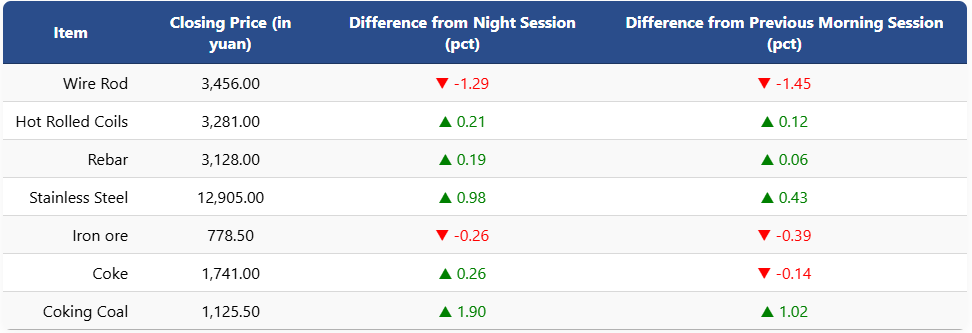

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.26pct to 778.5 yuan (USD 110.7) per ton. Coking coal futures rose 1.9pct to 1,125.5 yuan (USD 160) per ton, while coke futures edged up 0.26pct to 1,741 yuan (USD 248) per ton.

On the Shanghai Futures Exchange, rebar futures inched up to 3,128 yuan (USD 445) per ton, while HRC gained 0.21pct to 3,281 yuan (USD 467) per ton. Wire rod fell 1.29pct to 3,456 yuan (USD 492) per ton, while stainless steel futures rose nearly 1pct to 12,905 yuan (USD 1,836) per ton.

1 USD / 7.02 yuan