Iron ore futures retreated on Thursday, with weaker steel production data and the sharp rally earlier in the week dampening spot-market buying.

Iron ore futures had climbed in recent sessions on expectations of a rebound in steel output, potential restocking by Chinese mills amid low in-house inventories, and Beijing’s commitment to boost domestic demand while maintaining a moderately loose monetary policy.

However, the recent surge in futures pushed spot prices higher, curbing purchasing appetite among steelmakers as domestic steel demand has yet to show a meaningful recovery.

The pullback was also attributed to profit-taking, particularly after a speculative-led rally earlier in the week. This was evident in coal markets, where futures gains contrasted with minor price cuts in China’s physical market, highlighting a disconnect between speculative activity and near-term demand.

Meanwhile, data from the China Iron and Steel Association showed that average daily crude steel output at member mills fell to 1.64 mln tons during December 21-31, down 11pct from the previous ten-day period and more than 12pct YoY. Some analysts expect production to recover as environmental curbs ease and mills resume operations following planned maintenance.

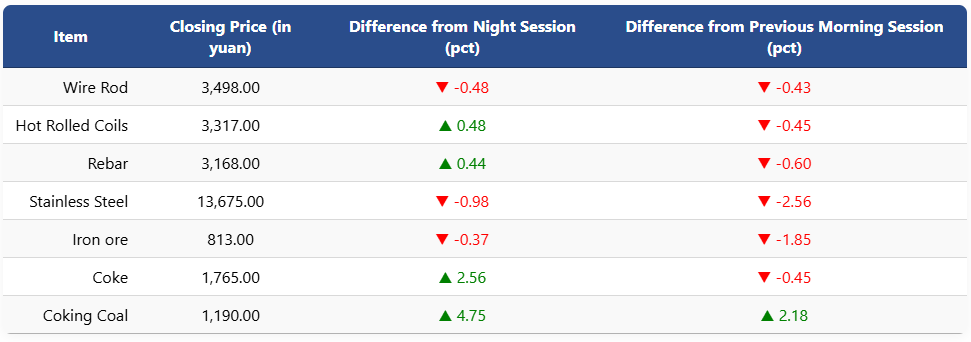

On the Dalian Commodity Exchange, the most-traded May iron ore contract slipped 0.37pct to 813 yuan (USD 116.4) per ton. Coking coal and coke futures rose 4.75pct and 2.56pct to 1,190 yuan (USD 170) and 1,765 yuan (USD 253) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures gained 0.44pct to 3,168 yuan (USD 454) per ton, while HRC futures rose 0.48pct to 3,317 yuan (USD 475) per ton. In contrast, wire rod futures edged down 0.48pct to 3,498 yuan (USD 501) per ton, and stainless steel futures fell 0.98pct to 13,675 yuan (USD 1,958) per ton.

1 USD / 6.98 yuan