Iron ore futures edged higher on Wednesday, supported by record Chinese steel export and iron ore import data, although overall market sentiment remained cautious.

Data from the General Administration of Customs showed that China’s steel exports reached a record monthly high in December and set a new annual record in 2025, while iron ore imports also hit record levels both for the month and the full year.

Iron ore futures were further underpinned by signs of recovering steel production and restocking demand ahead of the Chinese New Year holidays in February. However, gains were capped by the lack of momentum in finished steel prices, which continues to pressure Chinese steelmakers’ margins, as well as higher iron ore inventories at major ports.

Market participants also noted that the scope for another record year of steel exports appears limited, as Beijing seeks to ease trade tensions with key partners. The introduction of a steel export licensing regime is seen as part of efforts to moderate export volumes while encouraging stronger domestic consumption.

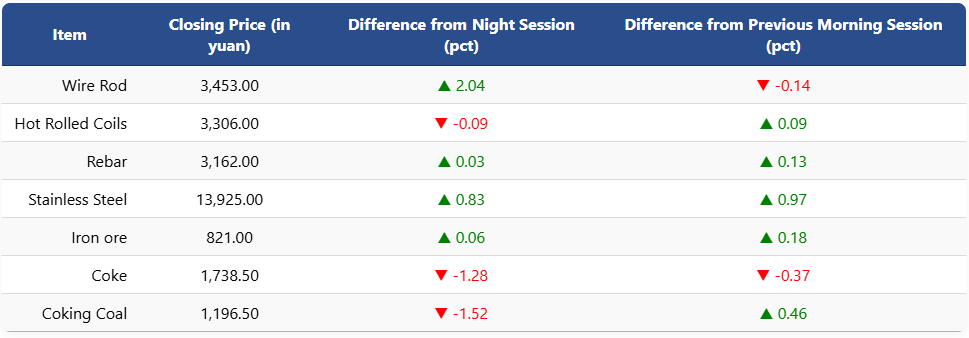

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose to 821 yuan (USD 117.7) per ton. Coking coal and coke futures fell 1.52pct and 1.28pct to 1,196.5 yuan (USD 172) and 1,738.5 yuan (USD 249) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures edged up to 3,162 yuan (USD 453) per ton, while HRC slipped 0.09pct to 3,306 yuan (USD 474) per ton. Wire rod futures gained 2.04pct to 3,453 yuan (USD 495) per ton, and stainless steel futures rose 0.83pct to 13,925 yuan (USD 1,997) per ton.

1 USD / 6.97 yuan