Iron ore futures edged lower on Tuesday as market sentiment remained cautious, although near-term factors helped limit losses.

Higher portside inventories in China, rising global iron ore supply and slow steel demand continued to weigh on the market, while the lack of momentum in finished steel prices kept steelmakers’ margins under pressure and capped upside for raw materials.

Some analysts said potential restocking by Chinese steel mills ahead of the Chinese New Year holidays in February, together with expectations of a gradual recovery in steel output as major mills complete maintenance, could lend short-term support. However, sentiment stayed restrained after major Chinese producer Shagang kept long steel prices unchanged for mid-January sales.

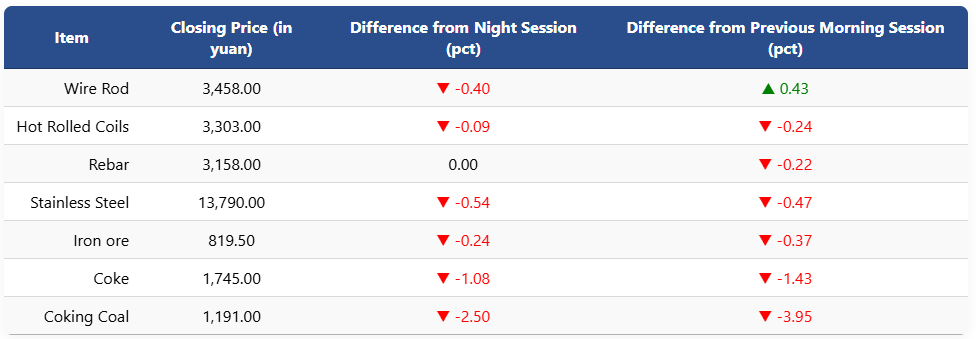

On the Dalian Commodity Exchange, the most-traded May iron ore contract slipped 0.24pct to 819.5 yuan (USD 117.4) per ton. Coking coal and coke futures fell 2.5pct and 1.08pct to 1,191 yuan (USD 171) and 1,745 yuan (USD 250) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures were unchanged at 3,158 yuan (USD 453) per ton, while HRC eased to 3,303 yuan (USD 474) per ton. Wire rod declined 0.4pct to 3,458 yuan (USD 496) per ton, and stainless steel futures dipped 0.54pct to 13,790 yuan (USD 1,977) per ton.

1 USD / 6.97 yuan