Iron ore futures inched lower on Wednesday as weak fundamentals continued to weigh on sentiment, though losses were limited by expectations that upcoming government meetings may deliver supportive policy signals.

Markets are awaiting guidance from the Central Economic Work Conference and the December Politburo meeting, where China will set its economic priorities for 2026 amid soft macroeconomic data.

China’s factory activity remained under pressure in November. The official manufacturing PMI rose slightly to 49.2 from 49.0 but stayed below the 50-point expansion threshold for the eighth consecutive month. A separate private survey also pointed to weakness, with the RatingDog China General Manufacturing PMI, compiled by S&P Global, falling to 49.9 in November, down from 50.6 in October.

Fundamental pressures persist for iron ore, with rising global supply and declining steel production keeping the outlook bearish.

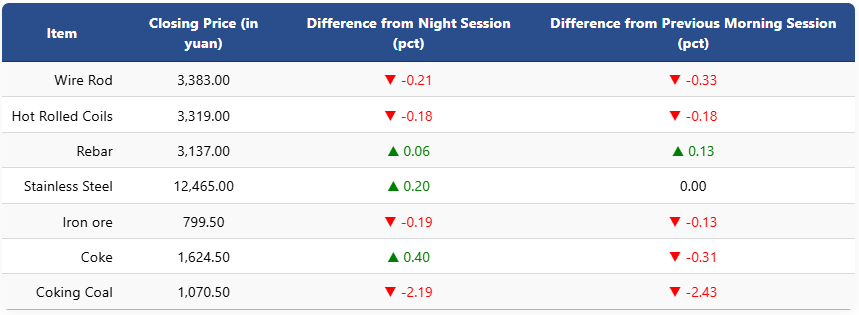

On the Dalian Commodity Exchange, the most-traded January iron ore contract slipped 0.19pct to 799.5 yuan (USD 113.1) per ton. Coking coal fell 2.19pct to 1,070.5 yuan (USD 152), while coke rose 0.4pct to 1,624.5 yuan (USD 230) a ton.

On the Shanghai Futures Exchange, rebar edged up to 3,137 yuan (USD 444), HRC dipped 0.18pct to 3,319 yuan (USD 470), wire rod fell 0.21pct to 3,383 yuan (USD 479), and stainless steel gained 0.2pct to 12,465 yuan (USD 1,765) per ton.

1 USD / 7.06 yuan