Iron ore futures inched higher on Thursday, supported by China’s latest fiscal stimulus measures, although gains remained limited amid continued concerns over rising supply.

Iron ore futures found some support after Beijing said it would allocate 93.6 bln yuan (USD 13.4 bln) from ultra-long special treasury bond funds to support equipment upgrades across key economic sectors, according to the National Development and Reform Commission (NDRC). The funds will also be channeled to local governments for targeted programmes, including the replacement of old trucks, upgrades to urban bus fleets with new energy vehicles, and the phase-out of obsolete agricultural machinery.

However, supply-side pressure continued to weigh on the market. Fortescue reported a 2pct increase in iron ore shipments in Q2 and maintained its FY26 shipment guidance, with quarterly volumes steady at 50.5 mln tons. The update follows higher output and shipments reported by Rio Tinto for Q4 2025 and record iron ore production by BHP Group in the first half of FY26.

The strong supply from major miners, combined with already high inventories at key Chinese ports, kept the broader outlook for iron ore under pressure.

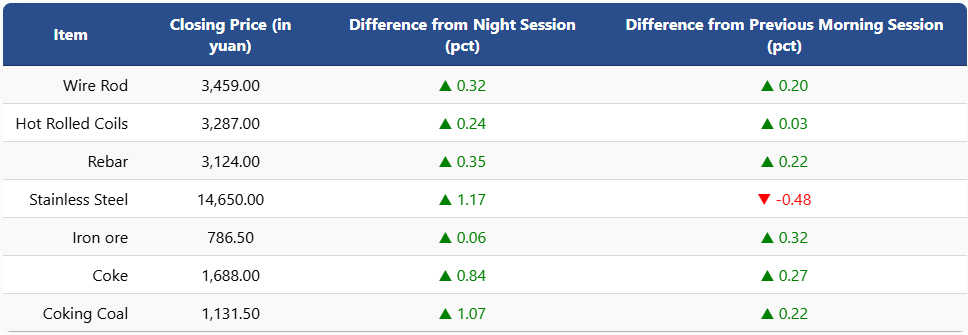

On the Dalian Commodity Exchange, the most-traded May iron ore contract edged up 0.06pct to 786.5 yuan (USD 112.7) per ton. Coking coal and coke futures also rose, gaining 1.07pct and 0.84pct to 1,131.5 yuan (USD 162) and 1,688 yuan (USD 242) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures increased 0.35pct to 3,124 yuan (USD 448) per ton, while HRC edged higher to 3,287 yuan (USD 471). Wire rod rose 0.32pct to 3,459 yuan (USD 496), and stainless steel futures advanced 1.17pct to 14,650 yuan (USD 2,100) per ton.

1 USD / 6.97 yuan