Iron ore futures rose further on Thursday, supported by easing domestic steel inventories and expectations of near-term restocking demand, which improved overall market sentiment.

Inventories of major finished steel products at key domestic warehouses declined, reflecting reduced supply pressure after several weeks of falling steel output. Firmer finished steel prices have helped improve steelmakers’ margins, lending support to iron ore demand.

The China Iron and Steel Association (CISA) also underscored the need to improve industry profitability through self-regulation and more disciplined export management. CISA warned that high-volume, low-priced steel exports are unsustainable, exacerbate global trade frictions, and could ultimately worsen domestic supply-demand imbalances.

Seasonal restocking ahead of the Lunar New Year holidays in February also provided support to the iron ore market.

On the macro front, sentiment was further buoyed by news that Beijing plans to develop a pilot free trade zone and eventually a free trade port in Hainan province, signaling China’s commitment to further opening up its economy.

However, the broader outlook for iron ore remains uncertain amid elevated portside inventories, environmental-related production curbs in several regions, and persistent weakness in China’s property sector.

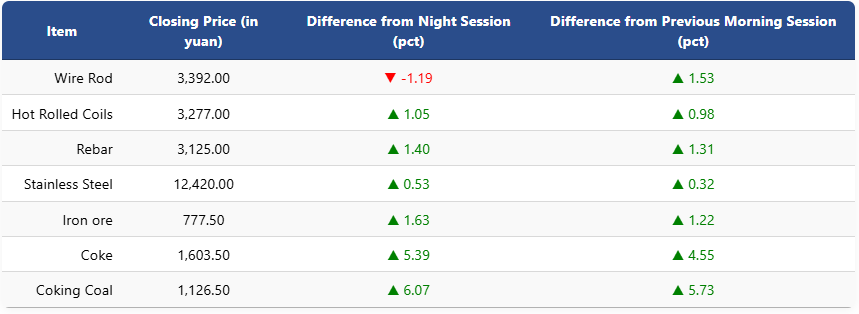

On the Dalian Commodity Exchange, the most-traded May iron ore contract climbed 1.63pct to 777.5 yuan (USD 110.4) per ton. Coking coal surged 6.07pct to 1,126.5 yuan (USD 160) per ton, while coke jumped 5.39pct to 1,603.5 yuan (USD 228) per ton.

On the Shanghai Futures Exchange, rebar futures rose 1.4pct to 3,125 yuan (USD 444) per ton and HRC gained 1.05pct to 3,277 yuan (USD 465) per ton. Wire rod slipped 1.19pct to 3,392 yuan (USD 482) per ton, while stainless steel futures increased 0.53pct to 12,420 yuan (USD 1,764) per ton.

1 USD / 7.04 yuan