Iron ore futures extended gains on Tuesday, supported by improving market sentiment and expectations of stronger near-term demand.

Prices were underpinned by the likelihood of a rebound in Chinese steel output as environment-related production curbs ease and several mills complete planned maintenance, potentially triggering iron ore restocking ahead of the Chinese New Year holidays in February.

Sentiment was further boosted by a strong rally in Chinese equities, with the Shanghai Composite Index climbing to its highest level in a decade. Analysts attributed the surge to growing optimism over a continued recovery in China’s economic fundamentals, which also spilled over into commodity markets.

Adding to the positive outlook, major Chinese steelmaker Baosteel announced it would keep domestic flat steel prices unchanged for February sales, while raising prices by 100 yuan (USD 14) per ton for March deliveries, signaling confidence in post-holiday steel demand.

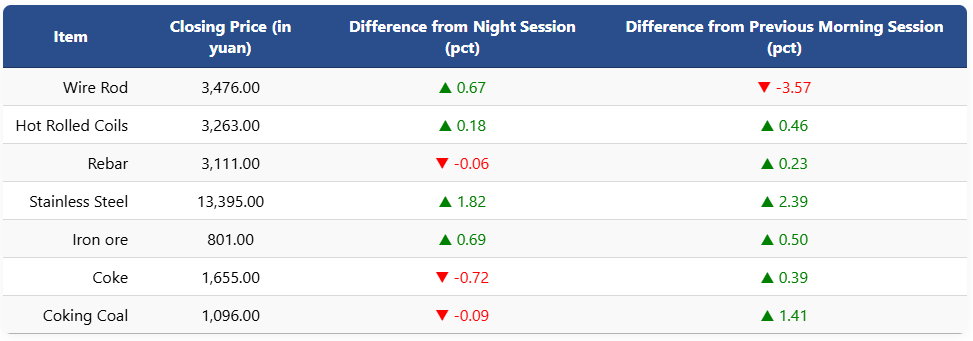

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.69pct to 801 yuan (USD 114.6) per ton. Coking coal futures edged lower to 1,096 yuan (USD 157) per ton, while coke futures slipped 0.72pct to 1,655 yuan (USD 237) per ton.

On the Shanghai Futures Exchange, rebar futures eased to 3,111 yuan (USD 445) per ton, while HRC futures gained 0.18pct to 3,263 yuan (USD 467) per ton. Wire rod futures rose 0.67pct to 3,476 yuan (USD 498) per ton, and stainless steel futures advanced 1.82pct to 13,395 yuan (USD 1,917) per ton.

Overall, most steelmaking raw material and steel futures posted gains compared with the previous morning session, reflecting broad-based improvement in market sentiment.

1 USD / 6.98 yuan