Iron ore futures fell again on Tuesday, pressured by rising global supply and slowing demand from Chinese steel mills.

Sentiment weakened further after reports that Guinea’s Simandou project, expected to produce 120 mln tons of high-grade ore annually, has dispatched its first shipment to China. The entry of this new supplier comes at a time when muted steel demand is already forcing Chinese mills to scale back output, reducing near-term iron ore consumption. Potential winter environmental curbs could further limit steel production.

Analysts highlighted the deteriorating fundamentals. ING noted that with manufacturing momentum softening, property activity still under strain, and policy support unlikely to fully offset these headwinds, China’s steel output is expected to remain under pressure, keeping iron ore demand subdued. The bank forecasts iron ore prices to average USD 95 per ton in 2026.

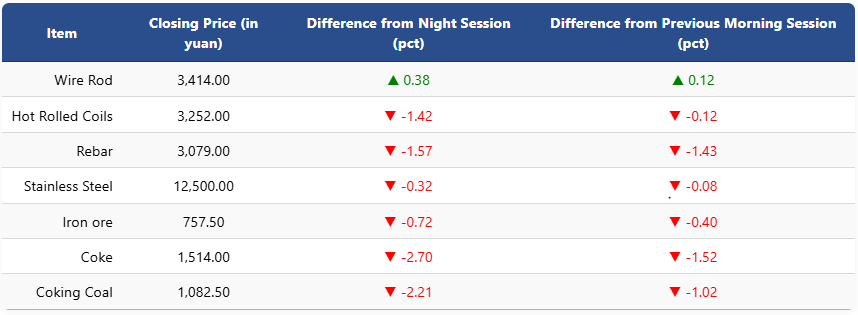

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.72pct to 757.5 yuan (USD 107.2) per ton. Coking coal dropped 2.21pct to 1,082.5 yuan (USD 153), while coke slid 2.7pct to 1,514 yuan (USD 214) a ton.

On the Shanghai Futures Exchange, rebar declined 1.57pct to 3,079 yuan (USD 436), HRC fell 1.42pct to 3,252 yuan (USD 460), wire rod edged up 0.38pct to 3,414 yuan (USD 483), and stainless steel slipped 0.32pct to 12,500 yuan (USD 1,770) per ton.

1 USD / 7.06 yuan