Iron ore futures extended losses on Wednesday, marking a fifth consecutive session of declines, as rising supply and lingering demand concerns continued to weigh on market sentiment.

Supply-side pressure intensified after Rio Tinto reported higher shipments and output in the Q4 2025, following BHP Group’s record iron ore production in the first half of FY26. The strong output from major producers, combined with already high inventories at major ports, has kept the market well supplied, limiting upside potential for prices despite expectations of restocking ahead of the Lunar New Year.

Concerns over demand have also resurfaced. Market participants fear that stricter safety inspections following a recent explosion at a Baotou Steel plant in Inner Mongolia could disrupt steel output and reduce iron ore consumption. In addition, reports of environment-related production curbs in several provinces have further dampened demand expectations.

Reflecting the cautious tone in the physical market, leading steelmaker Shagang Group kept domestic long steel prices unchanged for late January.

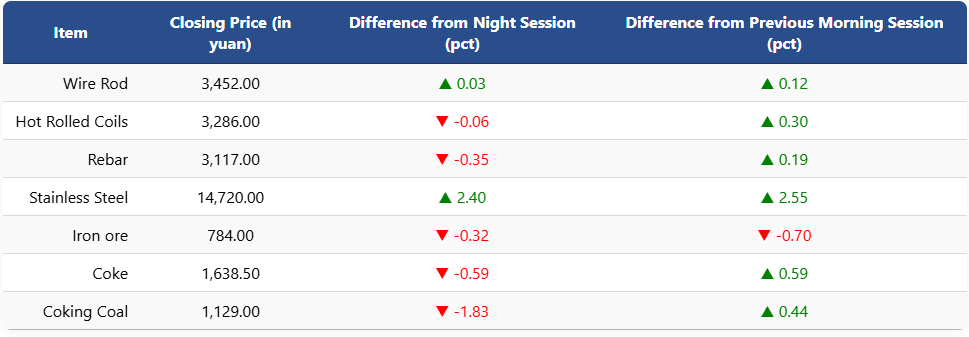

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.32pct to 784 yuan (USD 112.5) per ton. Coking coal and coke futures also declined, down 1.83pct and 0.59pct to 1,129 yuan (USD 162) and 1,683.5 yuan (USD 242) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures slipped 0.35pct to 3,117 yuan (USD 448) per ton, while HRC edged lower to 3,286 yuan (USD 472). Wire rod inched up 0.03pct to 3,452 yuan (USD 496), and stainless steel futures rose 2.4pct to 14,720 yuan (USD 2,114) per ton.

Overall, most steel and raw material futures, excluding iron ore, posted gains compared with the previous morning session.

1 USD / 6.96 yuan