Iron ore futures fell on Thursday, weighed down by weakening fundamentals and cautious sentiment across the steel value chain.

Rising supply combined with softer steel demand continued to pressure prices, while shrinking profit margins prompted Chinese mills to bring forward maintenance schedules, a move expected to curb steel production and reduce ore consumption. Environmental restrictions in several regions are also likely to dampen steel output, adding to the bearish outlook for iron ore.

In the physical market, Shagang Steel kept its long steel prices unchanged for mid-December sales, reflecting cautious buying sentiment.

Market sentiment was further affected by speculation that Chinese authorities may announce a steel export licensing system on Friday. While record export volumes this year have helped offset weak domestic demand, they have also intensified trade frictions with major partners.

Investors are now awaiting policy direction from Beijing, with attention focused on the upcoming Central Economic Work Conference, where key growth targets for 2025 are expected to be outlined.

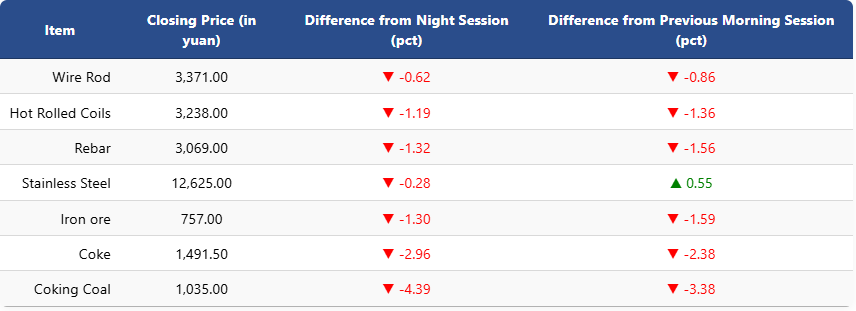

On the Dalian Commodity Exchange, the most-traded May iron ore contract slipped 1.3pct to 757 yuan (USD 107.2) per ton. Coking coal dropped 4.39pct to 1,035 yuan (USD 147), while coke declined 2.96pct to 1,491.5 yuan (USD 211) a ton.

On the Shanghai Futures Exchange, rebar fell 1.32pct to 3,069 yuan (USD 435), HRC dropped 1.19pct to 3,238 yuan (USD 459), and wire rod eased 0.62pct to 3,371 yuan (USD 478). Stainless steel dipped 0.28pct to 12,625 yuan (USD 1,789) per ton.

1 USD / 7.05 yuan