Iron ore futures posted modest gains in the first trading session of 2026, supported by short-term factors, although underlying market fundamentals remained fragile.

Prices were underpinned by the resumption of production at several Chinese steel mills following the completion of planned maintenance, as well as the easing of environment-related output curbs in some regions.

Market sentiment was further supported by expectations of iron ore restocking ahead of the Chinese New Year holidays in February. Anticipation of stronger steel demand during the pre-holiday period, reflected in declining inventories of major finished steel products at key Chinese warehouses, also lent support to iron ore prices.

Additional optimism stemmed from Beijing’s intention to boost domestic demand. The Chinese government has allocated around USD 8.9 bln to fund consumer subsidies for replacing household appliances in 2026, alongside large-scale equipment renewal programs. Such measures are expected to support manufacturing activity and provide some lift to domestic steel demand.

However, gains in iron ore futures were limited by rising global supply and increasing inventories at major Chinese ports. A cautious market outlook was reinforced after Shagang, a major Chinese steelmaker, announced that it would keep its domestic long steel prices unchanged for early January sales.

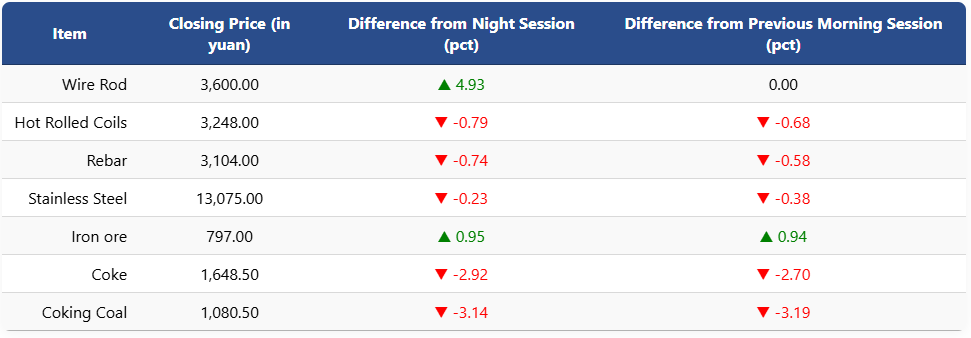

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 0.95pct to 797 yuan (USD 114.1) per ton. Coking coal futures fell 3.14pct to 1,080.5 yuan (USD 155) per ton, while coke futures declined 2.92pct to 1,648.5 yuan (USD 236) per ton.

On the Shanghai Futures Exchange, rebar futures slipped 0.74pct to 3,104 yuan (USD 444) per ton, and HRC futures fell 0.79pct to 3,248 yuan (USD 465) per ton. In contrast, wire rod futures surged 4.93pct to 3,600 yuan (USD 515) per ton, while stainless steel futures edged down 0.23pct to 13,075 yuan (USD 1,872) per ton.

1 USD / 6.98 yuan