Iron ore futures traded in a narrow range on Monday, with improved macroeconomic sentiment providing some support, while weak fundamentals limited gains.

China’s consumer price index (CPI) rose 0.2pct YoY in October, the second straight month of mild inflation, and edged up 0.1pct from September, signaling a modest recovery in consumer demand. The producer price index (PPI) fell 2.1pct YoY, easing slightly from September’s 2.3pct decline, suggesting factory-gate deflation is gradually stabilizing despite continued pressure from industrial overcapacity.

The steel sector, however, continues to struggle with soft demand, weighing on iron ore consumption as mills curb output to stabilize finished steel prices and protect margins. Seasonal environmental curbs and rising port inventories are adding further pressure on iron ore outlook.

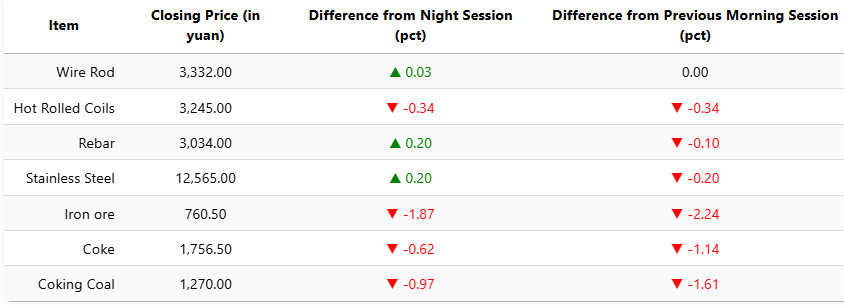

On the Dalian Commodity Exchange, the most-traded January iron ore contract edged up 0.07pct to 765.5 yuan (USD 107.5) per ton. Coking coal fell 1.02pct to 1,265.5 yuan (USD 178), and coke declined 1.19pct to 1,743.5 yuan (USD 245) per ton.

On the Shanghai Futures Exchange, rebar rose 0.26pct to 3,044 yuan (USD 428), HRC increased 0.06pct to 3,252 yuan (USD 457), wire rod slipped to 3,332 yuan (USD 468), and stainless steel climbed 0.28pct to 12,605 yuan (USD 1,770) per ton.

1 USD / 7.11 yuan