Iron ore futures rose on Thursday as expectations of a near-term recovery in steel demand improved market sentiment ahead of the Lunar New Year holidays, although broader demand concerns persisted.

Market sources said iron ore restocking activity showed signs of improvement as some Chinese steel mills that had undergone maintenance earlier began resuming production, supporting prospects for higher steel output in the near term.

However, sentiment remained cautious amid sluggish steel demand and winter-related environmental restrictions, which could continue to limit iron ore consumption. Higher portside iron ore inventories and rising global supply also remained key headwinds for the market.

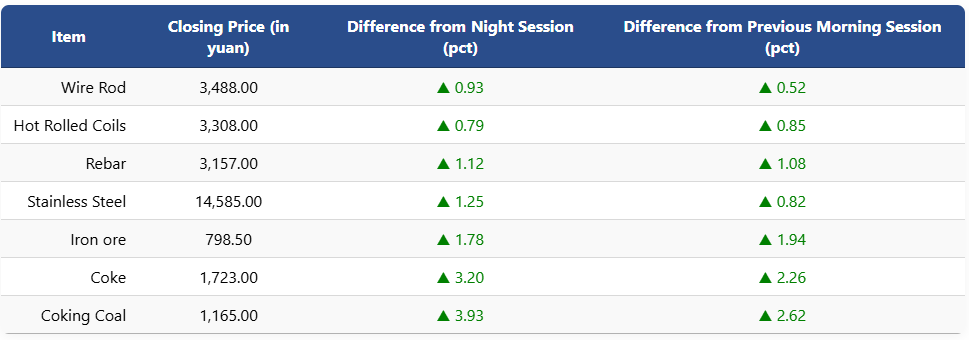

On the Dalian Commodity Exchange, the most-traded May iron ore contract climbed 1.78pct to 798.5 yuan (USD 114.9) per ton. Coking coal and coke futures jumped 3.93pct and 3.2pct to 1,165 yuan (USD 168) and 1,723 yuan (USD 248) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures gained 1.12pct to 3,157 yuan (USD 454) per ton, while HRC rose 0.79pct to 3,308 yuan (USD 476) a ton. Wire rod futures increased 0.93pct to 3,488 yuan (USD 502), and stainless steel futures advanced 1.25pct to 14,585 yuan (USD 2,099) per ton.

1 USD / 6.94 yuan