Iron ore futures rebounded on Wednesday after several sessions of losses, supported by growing expectations that Beijing may introduce new stimulus measures following another round of weak economic data.

The latest indicators have led some analysts to believe that additional policy support will be required for China to meet its roughly 5pct growth target. China’s producer price index fell 2.2pct YoY in November, according to the National Bureau of Statistics, highlighting the challenge of reviving domestic demand. Bloomberg reported that authorities are considering stimulus aimed at stabilizing the troubled property sector, helping lift property stocks. Markets are now focused on the upcoming Central Economic Work Conference later this month for policy signals.

Major steel producer, Baosteel raised its January HRC prices by USD 14 per ton, reflecting expectations of firmer steel prices as recent production cuts ease pressure on finished steel inventories.

Still, the outlook for iron ore remains clouded by weak steel demand. China Mineral Resources Group (CMRG), the state-owned agency centralizing ore procurement for major mills, warned that prices have become increasingly disconnected from fundamentals, describing the recent surge as driven largely by speculation rather than real demand.

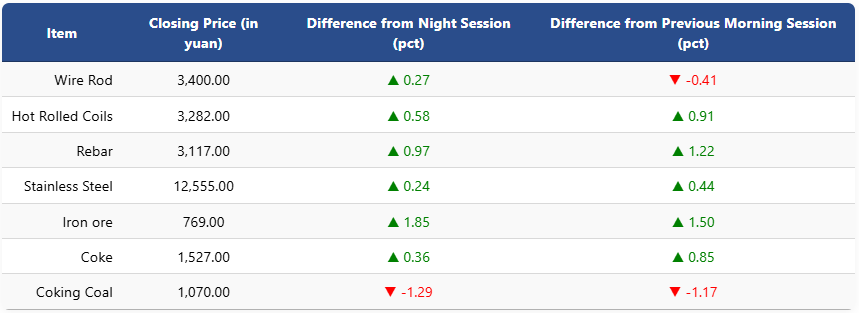

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 1.85pct to 769 yuan (USD 108.8) per ton. Coking coal fell 1.29pct to 1,070 yuan (USD 151), while coke edged up 0.36pct to 1,527 yuan (USD 216) a ton.

On the Shanghai Futures Exchange, rebar climbed 0.97pct to 3,117 yuan (USD 441), HRC rose 0.58pct to 3,282 yuan (USD 465), wire rod added 0.27pct to 3,400 yuan (USD 481), and stainless steel increased 0.24pct to 12,555 yuan (USD 1,778) per ton.

1 USD / 7.06 yuan