Iron ore futures recovered on Tuesday, supported by higher steel production figures, although the broader demand outlook remained bearish amid weakening fundamentals.

Data from the China Iron and Steel Association (CISA) showed that member mills’ daily crude steel output averaged 1.87 mln tons in the first ten days of December, up 2.8pct from the last ten days of November. Output, however, was still down 7.7pct YoY. At the same time, finished steel inventories at CISA member mills rose 3.3pct over the same period, highlighting ongoing demand pressure.

Some analysts expect a short-term lift in iron ore prices ahead of seasonal restocking before the Lunar New Year holidays in February.

Despite this, concerns persist over rising iron ore supply and elevated port inventories. Environmental curbs in densely populated regions during the winter may also limit steel production, weighing on iron ore consumption.

Demand is further pressured by weak domestic steel sales and the potential for slower exports next year following Beijing’s decision to introduce steel export licensing from January 1, 2026. While record exports in 2025 have helped offset domestic weakness, they have also intensified trade frictions.

Market participants noted that despite the futures rebound, sentiment in the physical market remains subdued. Some Chinese steel traders said new business has slowed amid uncertainty over the export licensing system, with a focus on completing shipments before year-end.

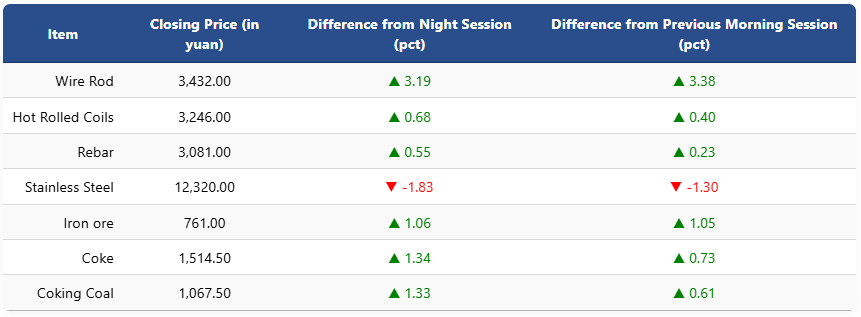

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 1.06pct to 761 yuan (USD 108) per ton. Coking coal gained 1.33pct to 1,067.5 yuan (USD 152), while coke increased 1.34pct to 1,514.5 yuan (USD 215) per ton.

On the Shanghai Futures Exchange, rebar rose 0.55pct to 3,081 yuan (USD 478), HRC climbed 0.68pct to 3,246 yuan (USD 461), wire rod jumped 3.19pct to 3,432 yuan (USD 487), while stainless steel futures fell 1.83pct to 12,320 yuan (USD 1,749) per ton.

1 USD / 7.04 yuan