Iron ore futures remained under pressure on Friday as market sentiment stayed cautious amid rising supply and record-high inventories.

Iron ore stockpiles at major Chinese ports have reportedly climbed to around 170 mln tons, reflecting strong shipments from major miners and continuing to weigh on prices. Short-term supportive factors such as recovering steel output and restocking ahead of the Lunar New Year were largely offset by the higher portside inventories.

Seasonal winter slowdown in steel demand, combined with environmental restrictions and intensified safety inspections across China following the recent explosion at a steel plant in Baotou, Inner Mongolia, continued to cap iron ore demand.

In the physical steel market, Chinese traders said fundamentals remain largely unchanged, with no strong drivers to lift demand or prices.

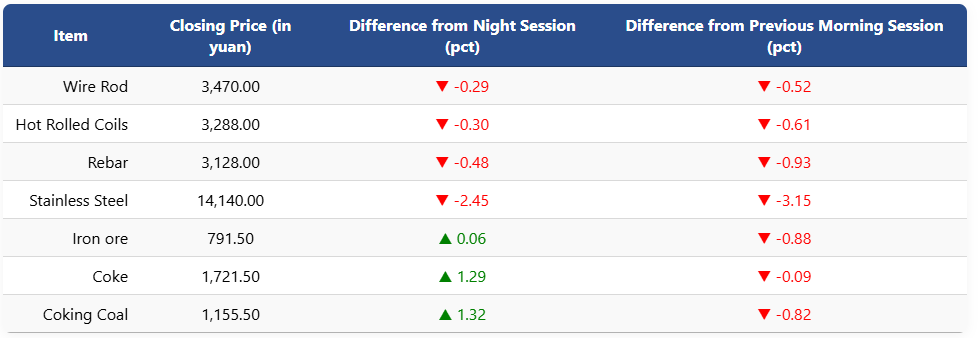

On the Dalian Commodity Exchange, the most-traded May iron ore contract edged up to 791.5 yuan (USD 113.8) per ton, but was down 0.88pct from the previous day’s morning session and 0.44pct lower compared with last Friday’s morning levels.

Coking coal and coke futures posted gains, rising 1.32pct to 1,155.5 yuan (USD 166) per ton and 1.29pct to 1,721.5 yuan (USD 248) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures fell 0.48pct to 3,128 yuan (USD 450) per ton, while HRC declined 0.3pct to 3,288 yuan (USD 473). Wire rod futures slipped 0.29pct to 3,470 yuan (USD 499), and stainless steel futures dropped 2.45pct to 14,140 yuan (USD 2,035) per ton.

1 USD / 6.94 yuan