Iron ore futures fell on Friday as weak steel fundamentals and soft economic data dampened market sentiment.

Iron ore futures rallied earlier in the week on optimism over easing U.S.-China trade tensions, but momentum faded as production curbs in Tangshan and weak steel demand eroded mills’ profitability, raising expectations of output cuts. China’s apparent steel consumption fell 5.7pct YoY to 649 mln tons in the first nine months of 2025, and total annual demand is set to decline for the fifth consecutive year, according to the China Iron and Steel Association (CISA).

Further weighing on sentiment, China’s official manufacturing purchasing managers’ index (PMI) slipped to 49.0 in October from 49.8 in September, according to the National Bureau of Statistics, remaining below the 50-point threshold separating growth from contraction.

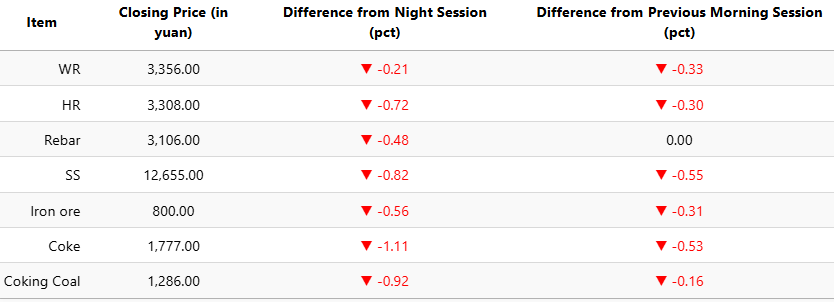

On the Dalian Commodity Exchange, the most-traded January iron ore contract dropped 0.56pct to 800 yuan (USD 112.3) per ton, though prices were still up 3.76pct from last Friday’s close.

Dalian coking coal futures fell 0.92pct to 1,286 yuan (USD 181), while coke declined 1.11pct to 1,777 yuan (USD 250) per ton.

On the Shanghai Futures Exchange, rebar slipped 0.48pct to 3,106 yuan (USD 436) per ton, HRC fell 0.72pct to 3,308 yuan (USD 465), wire rod eased 0.21pct to 3,356 yuan (USD 471), and stainless steel declined 0.82pct to 12,655 yuan (USD 1,778) per ton.

1 USD / 7.11 yuan