Iron ore futures rose on Friday, supported by pre-holiday restocking by Chinese steel mills, although concerns over rising supply are expected to limit further upside.

Steelmakers increased inquiries and procurement ahead of the Lunar New Year, seeking to take advantage of recent price declines to optimize raw material costs. Market participants also expect a short-term recovery in steel production, providing some support to iron ore demand.

However, the support is seen as temporary, with record-high iron ore inventories at Chinese ports and rising global supply continuing to weigh on the market outlook.

Chinese steel traders said expectations of improved steel demand after the Lunar New Year in February remain dependent on additional policy measures to inject fresh momentum into the economy.

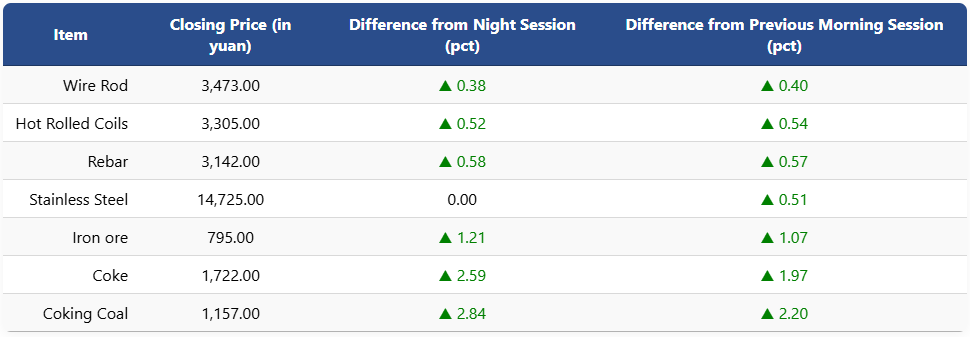

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 1.21pct to 795 yuan (USD 114.1) per ton, though it was still down about 2.1pct compared with last Friday’s morning close.

Coking coal and coke futures also posted gains, rising 2.89pct and 2.59pct to 1,157 yuan (USD 166) and 1,722 yuan (USD 247) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures increased 0.58pct to 3,142 yuan (USD 451) per ton, HRC gained 0.52pct to 3,305 yuan (USD 475), and wire rod rose 0.38pct to 3,473 yuan (USD 499). Stainless steel futures were unchanged at 14,725 yuan (USD 2,114) per ton.

1 USD / 6.96 yuan