Iron ore futures extended losses on Tuesday as disappointing manufacturing data and weak market fundamentals deepened concerns over steel demand in China.

The RatingDog China General Manufacturing PMI, compiled by S&P Global, eased to 50.6 in October, down from the previous month, with new export orders falling at the fastest pace since May. Although still in expansion territory, the reading contrasted with the official PMI released last week by the National Bureau of Statistics, which showed a sharper contraction at 49, marking the seventh consecutive monthly decline and the lowest level in six months.

On the supply side, portside iron ore inventories continued to build up, as Chinese mills slowed restocking amid weaker profit margins and subdued demand. Finished steel prices remain under pressure following higher production levels earlier in the year.

Reflecting this cautious sentiment, major steelmaker Shagang kept its long steel prices unchanged for November 1-10 sales.

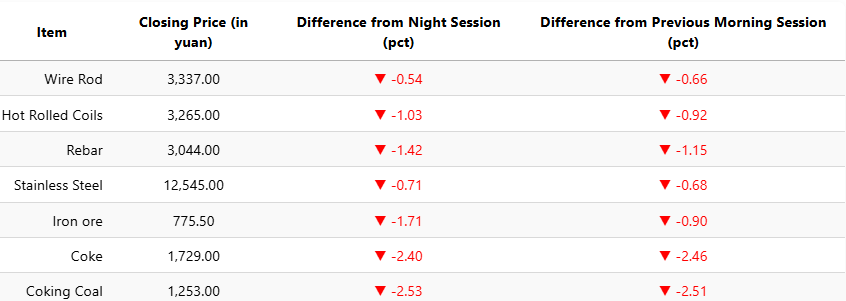

On the Dalian Commodity Exchange, the most-traded January iron ore contract fell 1.7pct to 775.5 yuan (USD 108.8) per ton. Coking coal dropped 2.5pct to 1,253 yuan (USD 176), and coke declined 2.4pct to 1,729 yuan (USD 243) a ton.

On the Shanghai Futures Exchange, rebar slid 1.4pct to 3,044 yuan (USD 427), HRC fell 1.0pct to 3,265 yuan (USD 458), wire rod eased 0.5pct to 3,337 yuan (USD 468), and stainless steel was down 0.7pct to 12,545 yuan (USD 1,761) per ton.

1 USD / 7.12 yuan