Iron ore futures extended losses on Wednesday as weak steel demand and rising supply continued to weigh on market sentiment.

Fundamentals remain under pressure amid record-high iron ore inventories at Chinese ports and increasing seaborne supply. Major miner Vale reported record iron ore output in 2025, adding to oversupply concerns.

Demand-side sentiment was further dampened as some Chinese steel mills delayed production restarts due to sluggish steel demand, reducing iron ore consumption. Seasonal winter slowdown has also weighed on steel demand, limiting restocking activity by mills. In addition, steel output may face further pressure from environmental restrictions and safety inspections following an explosion at a steel plant in Baotou, Inner Mongolia, earlier this month.

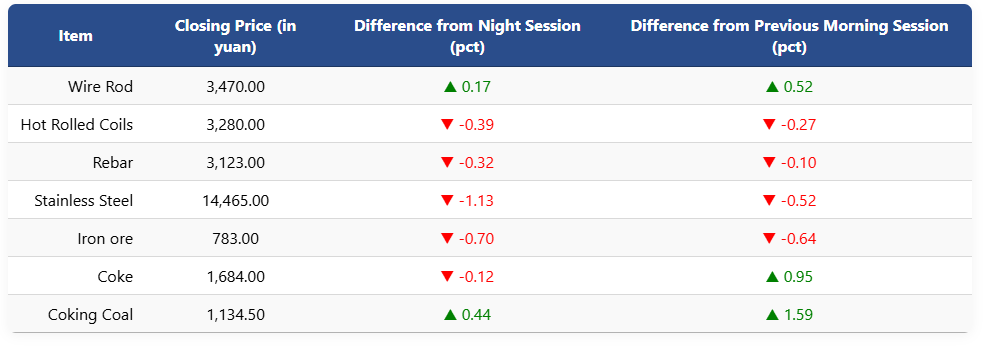

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.7pct to 783 yuan (USD 112.7) per ton. Coking coal futures rose 0.44pct to 1,134.5 yuan (USD 163), while coke futures edged down 0.12pct to 1,684 yuan (USD 242) per ton.

On the Shanghai Futures Exchange, rebar futures slipped 0.32pct to 3,123 yuan (USD 450) per ton, while HRC fell 0.39pct to 3,280 yuan (USD 472). Wire rod futures gained 0.17pct to 3,470 yuan (USD 499), while stainless steel futures declined 1.13pct to 14,465 yuan (USD 2,082) per ton.

1 USD / 6.94 yuan