Iron ore futures declined on Tuesday as the market remained caught between weak current fundamentals and short-term optimistic expectations, keeping sentiment mixed.

Market participants said shipments from major miners picked up this week, adding pressure as iron ore inventories at major Chinese ports remain at higher levels. Chinese steel traders noted that steel trading activity has slowed, although prices have stayed relatively stable as mills focus on limiting production to avoid further pressure on finished steel prices, an approach that continues to weigh on iron ore consumption.

However, some analysts expect Chinese steel mills to begin restocking iron ore ahead of the Chinese New Year holidays in February. In addition, several mills are likely to resume production after completing planned maintenance, which could provide near-term support to iron ore demand.

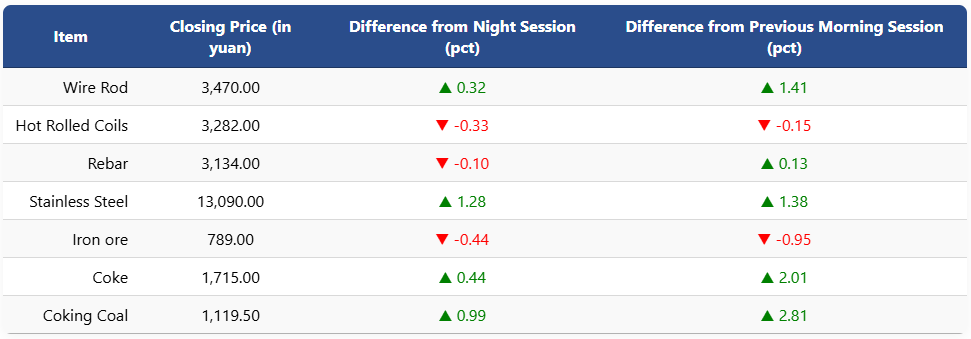

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.44pct to 789 yuan (USD 112.8) per ton. Coking coal futures rose nearly 1pct to 1,119.5 yuan (USD 160) per ton, while coke futures gained 0.44pct to 1,715 yuan (USD 245) per ton.

On the Shanghai Futures Exchange, rebar futures edged down to 3,134 yuan (USD 448) per ton, while HRC slipped 0.33pct to 3,282 yuan (USD 469) per ton. Wire rod rose 0.32pct to 3,470 yuan (USD 496) per ton, and stainless steel futures climbed 1.28pct to 13,090 yuan (USD 1,872) per ton.

1 USD / 6.99 yuan