Iron ore futures remained subdued on Monday as oversupply pressure continued to weigh on market sentiment.

Rising global supply, together with high iron ore inventories at major Chinese ports, kept the market under pressure. While pre-holiday restocking by Chinese steel mills ahead of the Lunar New Year in February has begun, buying has largely focused on lower-priced grades, limiting upside in prices as mills seek to protect margins amid weak finished steel demand.

Analysts said restocking activity could help limit sharp price declines but is unlikely to drive a sustained rebound. Expectations of a recovery in steel output may provide some support, although this has yet to materialize. Data from the China Iron and Steel Association (CISA) showed that average daily crude steel output among member mills stood at around 1.98 mln tons per day during January 11-20, down 0.9pct from early January and 4.5pct YoY.

Chines steel traders added that physical steel restocking remains slower than usual ahead of the holiday period, citing a lack of demand-side drivers during the winter season.

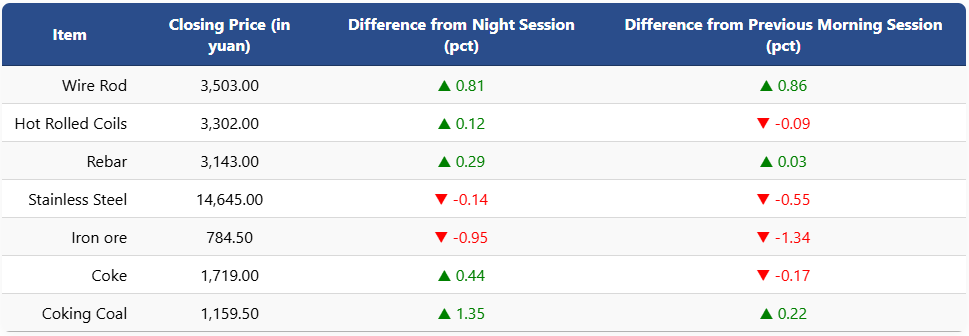

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.95pct to 784.5 yuan (USD 112.8) per ton. Coking coal and coke futures gained 1.35pct and 0.44pct to 1,159.5 yuan (USD 167) and 1,719 yuan (USD 247) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures rose 0.29pct to 3,143 yuan (USD 452) per ton, HRC edged up 0.12pct to 3,302 yuan (USD 475), and wire rod climbed 0.81pct to 3,503 yuan (USD 504). Stainless steel futures slipped slightly to 14,645 yuan (USD 2,106) per ton.

1 USD / 6.95 yuan