Iron ore futures rallied sharply on Wednesday after Beijing reaffirmed its commitment to maintaining a moderately loose monetary policy in 2026. China’s central bank said it would continue to ensure ample liquidity through tools such as reserve requirement ratio and interest rate cuts, lifting sentiment across commodity markets.

Market optimism was further boosted as coking coal and coke futures hit their upper limits, amid rumours that authorities may implement coal capacity cuts in Shaanxi province. Supply concerns were compounded by stronger seasonal coal demand due to cold weather, alongside stricter safety and environmental supervision, all of which fuelled the rally in coal-related futures.

Iron ore prices also drew support from restocking demand by Chinese steel mills ahead of the Chinese New Year holidays in February, as well as expectations of a rebound in steel production. Adding to the positive outlook, the China Iron and Steel Association reported that domestic inventories of major finished steel products fell 3.6pct in late December from mid-December levels to 7.21 mln tons, reflecting tighter supply conditions and underpinning hopes for firmer steel prices amid improving demand.

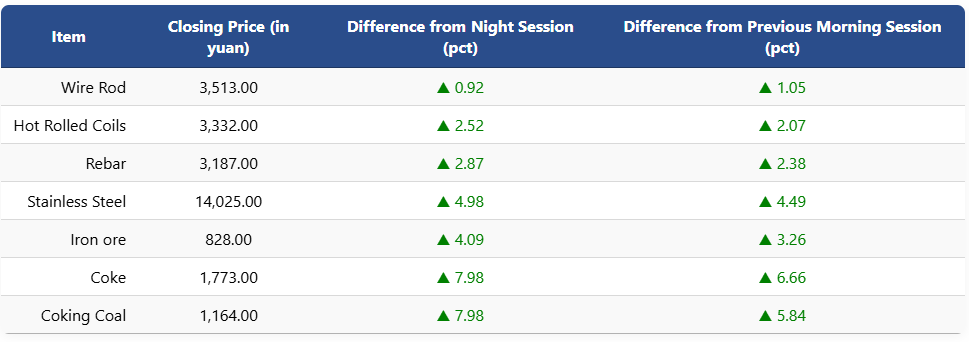

On the Dalian Commodity Exchange, the most-traded May iron ore contract jumped 4.09pct to 828 yuan (USD 118.3) per ton. Coking coal and coke futures both closed at their upper limits, at 1,164 yuan (USD 166) and 1,773 yuan (USD 254) per ton, respectively.

On the Shanghai Futures Exchange, rebar futures rose 2.87pct to 3,187 yuan (USD 456) per ton, while HRC futures gained 2.52pct to 3,332 yuan (USD 476) per ton. Wire rod futures increased 0.92pct to 3,513 yuan (USD 502) per ton, and stainless steel futures surged 4.98pct to 14,025 yuan (USD 2,005) per ton.

1 USD / 6.99 yuan