Iron ore futures traded in a narrow range on Tuesday, as persistent demand uncertainty kept market sentiment subdued.

Traders expect milder-than-anticipated output curbs by Chinese authorities, given that steel production continues to decline and is unlikely to exceed last year’s levels. However, weak steel demand and oversupply are weighing on finished steel prices and squeezing mills’ profitability, prompting many producers to scale back output.

Reflecting this cautious tone, major mills have kept domestic prices unchanged. Baosteel maintained its HRC prices for December sales, while Shagang held long steel prices steady for the November 11-20 period.

Market participants noted that lower steel prices have helped sustain demand, while potential production cuts could stabilize the market and lift sentiment in the near term.

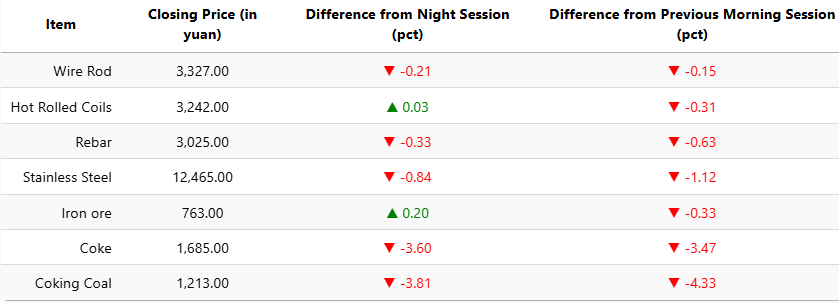

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 0.2pct to 763 yuan (USD 107.1) per ton. Coking coal fell 3.81pct to 1,213 yuan (USD 170), and coke declined 3.6pct to 1,685 yuan (USD 237) per ton.

On the Shanghai Futures Exchange, rebar slipped 0.23pct to 3,042 yuan (USD 427), HRC edged up to 3,242 yuan (USD 455), wire rod fell 0.21pct to 3,327 yuan (USD 467), and stainless steel dropped 0.84pct to 12,465 yuan (USD 1,751) per ton.

1 USD / 7.11 yuan