Iron ore futures continued to rise on Wednesday, supported by optimism over easing trade tensions between the United States and China, the world’s two largest economies. Market sentiment strengthened ahead of a planned meeting between the two countries’ leaders on Thursday, fueling hopes for progress toward a trade deal.

However, the demand outlook for steel and raw materials remains uncertain. Environmental restrictions in key regions, including the major steelmaking hub of Tangshan, combined with sluggish steel demand are pressuring Chinese mills, many of which have scaled back production due to weak profitability. Rising port inventories further reflect softening demand.

Additional headwinds have emerged from growing trade protectionism. Vietnam recently launched an anti-circumvention investigation into imports of wide HRC from China, following claims that Chinese exporters were evading existing antidumping duties by shipping HRC wider than 1,880 mm. The new probe will now cover widths up to 2,300 mm.

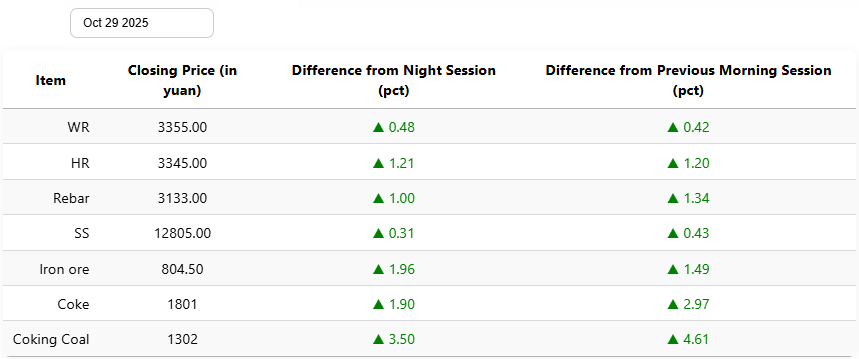

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 1.96pct to 804.5 yuan (USD 113.3) per ton. Coking coal futures climbed 3.5pct to 1,302 yuan (USD 183), and coke gained 1.9pct to 1,801 yuan (USD 254) per ton.

On the Shanghai Futures Exchange, rebar rose 1pct to 3,133 yuan (USD 441) per ton, HRC advanced 1.21pct to 3,345 yuan (USD 471), wire rod edged up 0.48pct to 3,355 yuan (USD 473), and stainless steel increased 0.31pct to 12,805 yuan (USD 1,804) per ton.

1 USD / 7.09 yuan