Iron ore futures fell again on Friday as soft fundamentals continued to keep market sentiment cautious.

Iron ore inventories at major Chinese ports are still rising and, combined with increasing global supply, are reinforcing a bearish outlook amid weakening steel production and sluggish demand.

Traders noted that easing supply tightness has slightly improved physical market sentiment but said more meaningful demand-side drivers are needed for any sustained recovery.

Meanwhile, market participants are awaiting guidance from the upcoming Central Economic Work Conference and the December Politburo meeting, where China will set its economic priorities for 2026.

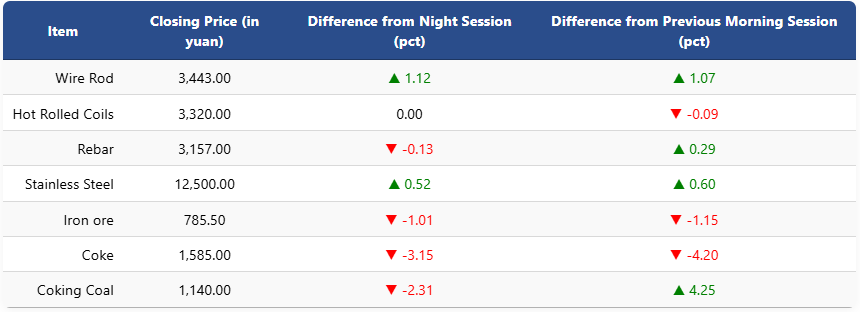

On the Dalian Commodity Exchange, the most-traded January iron ore contract slipped 1.01pct to 785.5 yuan (USD 111) per ton, down 1.94pct from last Friday’s morning close.

Coking coal fell 2.31pct to 1,140 yuan (USD 161), while coke declined 3.15pct to 1,585 yuan (USD 224) a ton.

On the Shanghai Futures Exchange, rebar edged down to 3,157 yuan (USD 446), HRC held steady at 3,320 yuan (USD 470), wire rod gained 1.12pct to 3,443 yuan (USD 487), and stainless steel rose 0.52pct to 12,500 yuan (USD 1,768) per ton.

1 USD / 7.07 yuan