Iron ore futures fell sharply on Monday as market sentiment deteriorated following Beijing’s move to introduce a steel export licensing system aimed at regulating overseas shipments next year.

China’s Ministry of Commerce said the licensing regime will take effect from January 1 and cover nearly the entire steel product range. While record-high steel exports in 2025 have helped offset weak domestic demand, they have also intensified trade tensions and prompted several countries to impose protective measures.

Iron ore fundamentals remain under pressure amid declining steel output, as shrinking margins and weak domestic demand force mills to cut production. China’s crude steel output fell nearly 11pct YoY in November and was down 3pct from October, marking the lowest monthly output since December 2023, according to data from the National Bureau of Statistics.

Sentiment was further dampened by weak economic indicators. Retail sales and industrial output growth both missed expectations, while fixed-asset investment declined 2.6pct YoY in the January-November period. Real estate investment fell 15.9pct over the same period, deepening the impact of the ongoing property slump, with home price declines in major cities accelerating in November. Auto retail sales volumes also dropped 8.1pct YoY in November, the first annual decline in three years, industry data showed.

Some analysts believe the deteriorating data could prompt Beijing to introduce additional policy support to stabilize growth, potentially lending short-term support to iron ore prices. Seasonal restocking ahead of the Lunar New Year in February may also provide limited upside, although sustained gains are unlikely without a major boost in domestic steel demand.

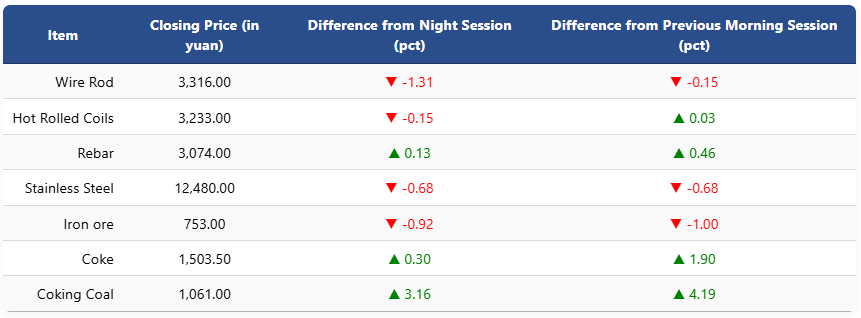

On the Dalian Commodity Exchange, the most-traded May iron ore contract fell 0.92pct to 753 yuan (USD 106.8) per ton. Coking coal rose 3.16pct to 1,061 yuan (USD 151), while coke edged up 0.3pct to 1,503.5 yuan (USD 213) per ton.

On the Shanghai Futures Exchange, rebar futures edged up to 3,074 yuan (USD 436), HRC slipped 0.15pct to 3,233 yuan (USD 459), wire rod fell 1.31pct to 3,316 yuan (USD 471), and stainless steel futures declined 0.68pct to 12,480 yuan (USD 1,771) per ton.

1 USD / 7.04 yuan