Iron ore futures edged higher on Thursday, supported by easing U.S.-China tensions, though profit-taking later trimmed early gains.

The United States and China have agreed to a one-year trade truce following high-level talks between Xi Jinping and Donald Trump. As part of the deal, Beijing will suspend newly announced rare earth export controls, while Washington will delay expanded entity list restrictions on Chinese firms. The U.S. will also halve tariffs on Chinese goods linked to fentanyl production.

Iron ore futures have rallied this week on hopes of improved bilateral relations, but sentiment cooled later in the session as weak steel demand and squeezed mill margins weighed on fundamentals. Analysts noted that Chinese steel producers may scale back output as rising raw material costs erode profitability, curbing iron ore consumption.

A sluggish property sector and growing global trade barriers against Chinese steel exports also remain key headwinds.

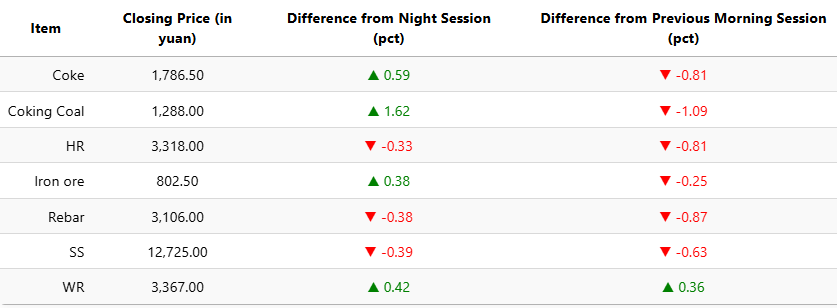

On the Dalian Commodity Exchange, the most-traded January iron ore contract edged up 0.38pct to 802.5 yuan (USD 112.8) per ton, slightly lower than the previous morning’s close. Coking coal rose 1.62pct to 1,288 yuan (USD 181), while coke gained 0.59pct to 1,786.5 yuan (USD 251) per ton.

On the Shanghai Futures Exchange, rebar slipped 0.38pct to 3,106 yuan (USD 437) per ton, HRC fell 0.33pct to 3,318 yuan (USD 466), and stainless steel declined 0.39pct to 12,725 yuan (USD 1,789). Only wire rod saw a modest uptick, rising 0.42pct to 3,367 yuan (USD 473) per ton.

1 USD / 7.11 yuan