Iron ore futures remained subdued on Friday, extending losses for a second consecutive session as weak steel demand continued to pressure prices, even though the most-traded contract still posted a modest week-on-week gain.

Soft demand from downstream sectors has kept finished steel prices under pressure, while Chinese mills are maintaining relatively high production levels despite recent declines. This oversupply is hurting steel prices and squeezing mill margins, raising the likelihood of future output cuts.

Sentiment is further dampened by potential environmental-related curbs, ongoing weakness in the property sector, and rising trade barriers against Chinese steel exports. However, Reuters reported that a standstill in contract talks with BHP and an expanded ban on a specific BHP ore type have offered some support to iron ore prices.

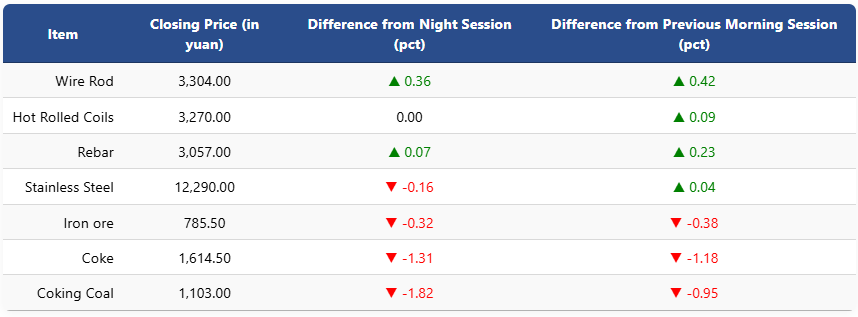

On the Dalian Commodity Exchange, the most-traded January iron ore contract slipped 0.32pct to 785.5 yuan (USD 110.4) per ton but gained 1.68pct compared with last Friday’s morning close.

Coking coal fell 1.82pct to 1,103 yuan (USD 155), while coke eased 1.31pct to 1,614.5 yuan (USD 227) per ton.

On the Shanghai Futures Exchange, rebar inched up to 3,057 yuan (USD 430), HRC was flat at 3,270 yuan (USD 460), wire rod gained 0.36pct to 3,304 yuan (USD 465), and stainless steel dipped 0.16pct to 12,290 yuan (USD 1,728) per ton.

1 USD / 7.11 yuan