Iron ore futures extended gains on Tuesday as lower shipments from major miners provided support, although the market’s longer-term outlook remains uncertain.

Analysts reported a week-on-week decline in supply from Australia and Brazil, while a pickup in domestic finished-steel demand added further strength to iron ore prices.

However, several factors continue to weigh on sentiment, including high port inventories, the expected seasonal slowdown in steel demand and environmental curbs during winter, rising protectionist measures against Chinese steel products, and ongoing weakness in China’s property sector, all of which keep the broader outlook bearish.

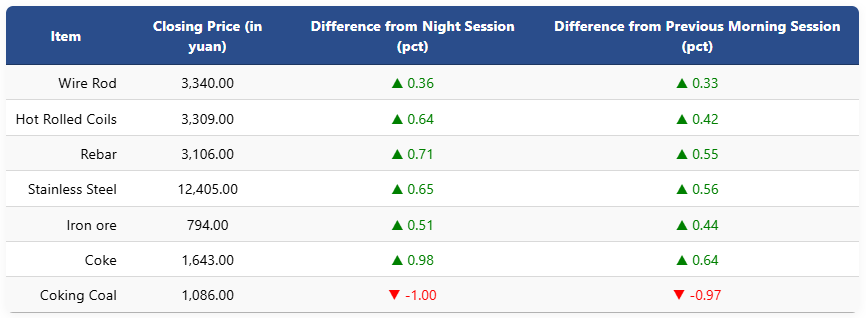

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 0.51pct to 794 yuan (USD 112) per ton. Coking coal fell 1pct to 1,086 yuan (USD 153), while coke gained 0.98pct to 1,643 yuan (USD 232).

On the Shanghai Futures Exchange, rebar increased 0.71pct to 3,106 yuan (USD 438), HRC rose 0.64pct to 3,309 yuan (USD 467), wire rod edged up 0.36pct to 3,340 yuan (USD 471), and stainless steel climbed 0.65pct to 12,405 yuan (USD 1,751) per ton.

1 USD / 7.08 yuan