Iron ore futures gained on Thursday, supported by moderate steel demand and higher production levels, though the broader outlook remains bearish.

Market sources reported a decline in finished steel inventories this week, but the traditional winter slowdown in steel consumption continues to limit confidence.

Higher steel production, despite an overall downward trend, provided some support to iron ore, while macro sentiment also improved on a softer U.S. dollar, expectations of a Federal Reserve rate cut, and signs of better U.S.-China trade relations.

However, demand risks persist. Shrinking margins at Chinese steel mills and potential environmental curbs may force output cuts, reducing iron ore consumption. Rising global supply and elevated port inventories in China also pose downside pressure.

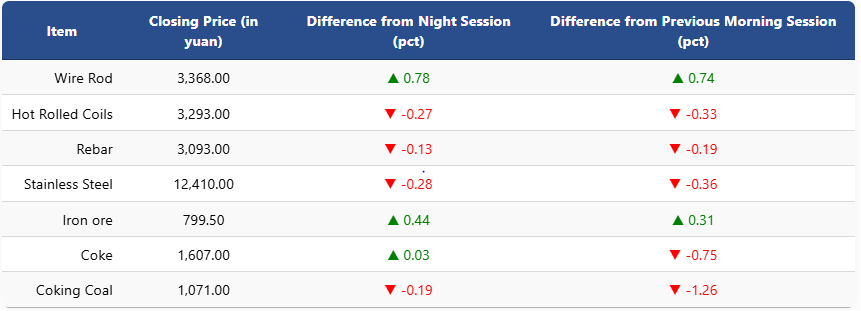

On the Dalian Commodity Exchange, the most-traded January iron ore contract rose 0.44pct to 799.5 yuan (USD 112.8) per ton. Coking coal slipped 0.19pct to 1,071 yuan (USD 151), while coke edged up to 1,607 yuan (USD 227) a ton.

On the Shanghai Futures Exchange, rebar dipped 0.13pct to 3,093 yuan (USD 437), HRC fell 0.27pct to 3,293 yuan (USD 465), wire rod climbed 0.78pct to 3,368 yuan (USD 475), and stainless steel eased 0.28pct to 12,410 yuan (USD 1,752) per ton.

1 USD / 7.08 yuan