Iron ore futures fell again on Thursday as rising global supply and lower steel production continued to pressure the market and keep sentiment bearish.

Vale cut its 2026 output forecast, citing softer global demand and the arrival of new supply from Africa, including Guinea’s Simandou project, which holds more than 4 bln tons of iron ore resources and has already dispatched its first high-grade shipment to China.

Chinese steel traders reported a decline in retail inventories this week, but largely due to reduced production rather than any meaningful improvement in demand.

Market participants are also awaiting signals from the Central Economic Work Conference and December’s Politburo meeting, where China will set its economic priorities for 2026.

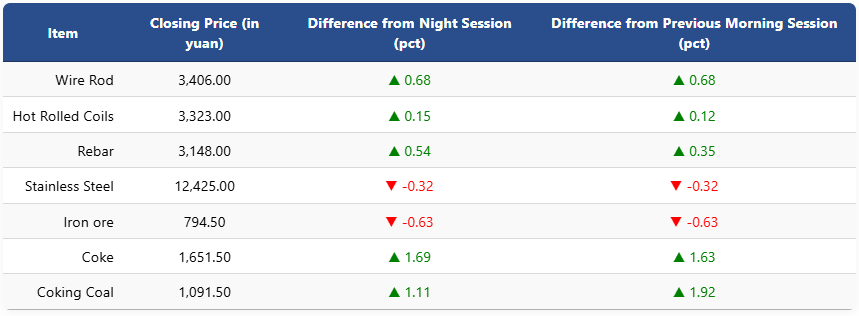

On the Dalian Commodity Exchange, the most-traded January iron ore contract slipped 0.63pct to 794.5 yuan (USD 112.3) per ton. Coking coal rose 1.11pct to 1,091.5 yuan (USD 154), while coke gained 1.69pct to 1,651.5 yuan (USD 234) a ton.

On the Shanghai Futures Exchange, rebar increased 0.54pct to 3,148 yuan (USD 445), HRC edged up 0.15pct to 3,323 yuan (USD 470), and wire rod rose 0.68pct to 3,406 yuan (USD 482). Stainless steel dipped 0.32pct to 12,425 yuan (USD 1,757) per ton.

1 USD / 7.07 yuan