Iron ore futures extended gains on Wednesday, supported by an uptick in near-term demand, although the longer-term outlook remains bearish.

Chinese steel mills have been replenishing raw material stocks ahead of seasonal restocking before the Lunar New Year holidays in February, providing short-term support to iron ore prices. Some analysts also noted that continued declines in steel production have eased pressure on finished steel prices, potentially improving mill profitability and lending temporary support to iron ore futures.

Sentiment has also been helped by Beijing’s renewed focus on boosting domestic demand, alongside plans to rein in record steel exports through the introduction of an export licensing system from January 2026, which could improve steel market fundamentals.

In addition, iron ore prices have found support from an ongoing commercial dispute between China Mineral Resources Group (CMRG) and BHP. Market sources said CMRG has restricted purchases of certain low-grade BHP products, raising concerns over near-term supply tightness.

Despite the recent gains, upside remains limited by high iron ore inventories at major Chinese ports, rising global supply, declining steel output, and winter-related environmental curbs in several regions.

Most analysts continue to view the longer-term outlook for iron ore as negative. Australia’s Westpac Banking Corp said in a note that a price correction is likely as costs of steelmaking raw materials rise while Chinese steel prices weaken, creating the widest divergence since mid-2024. Westpac expects iron ore prices to fall around 20pct, reaching about USD 83 per ton by the end of 2026.

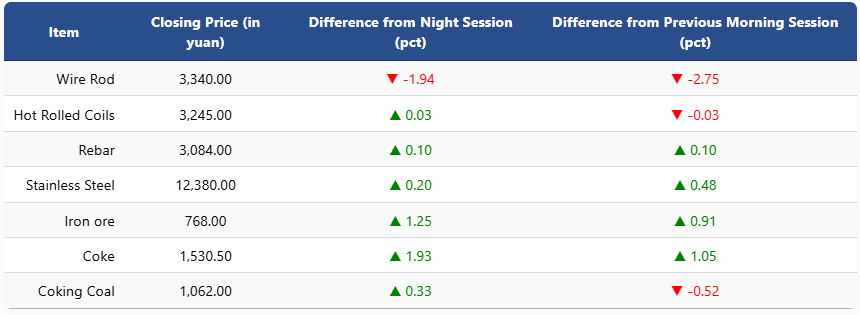

On the Dalian Commodity Exchange, the most-traded May iron ore contract rose 1.25pct to 768 yuan (USD 109) per ton. Coking coal edged up 0.33pct to 1,062 yuan (USD 151), while coke climbed 1.93pct to 1,530.5 yuan (USD 217).

On the Shanghai Futures Exchange, rebar and HRC futures inched up to 3,084 yuan (USD 438) and 3,245 yuan (USD 461), respectively. Wire rod fell 1.94pct to 3,340 yuan (USD 474), while stainless steel futures gained 0.2pct to 12,380 yuan (USD 1,758) per ton.

1 USD / 7.04 yuan